OTM Market Update – Consolidation

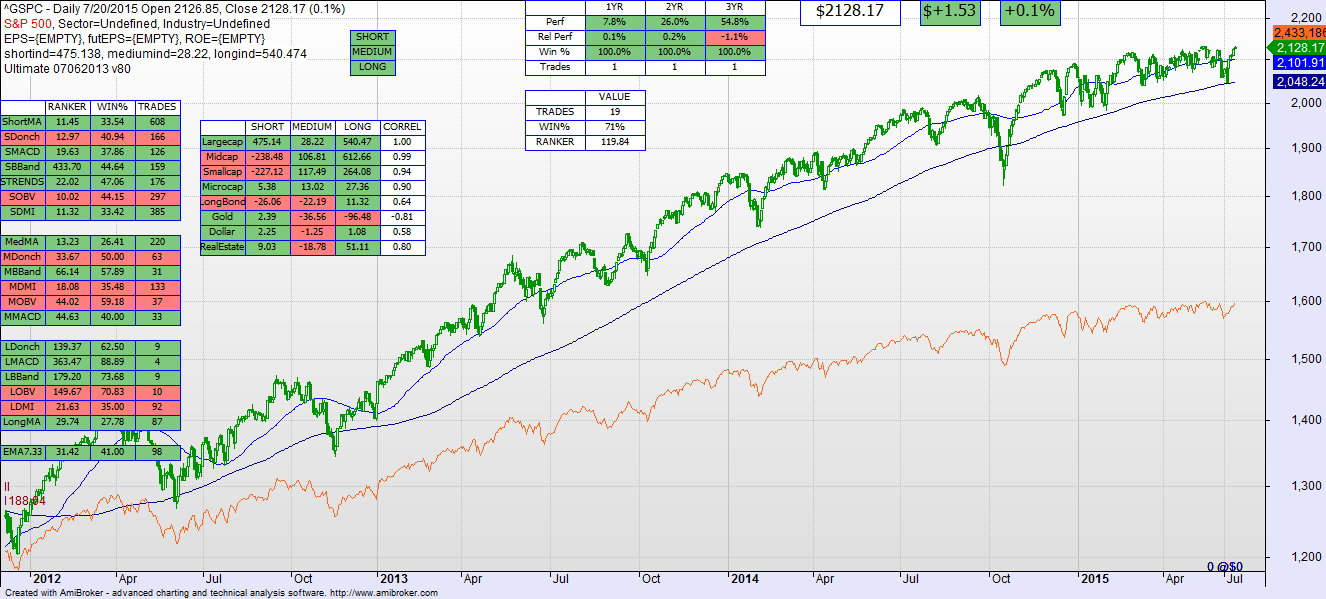

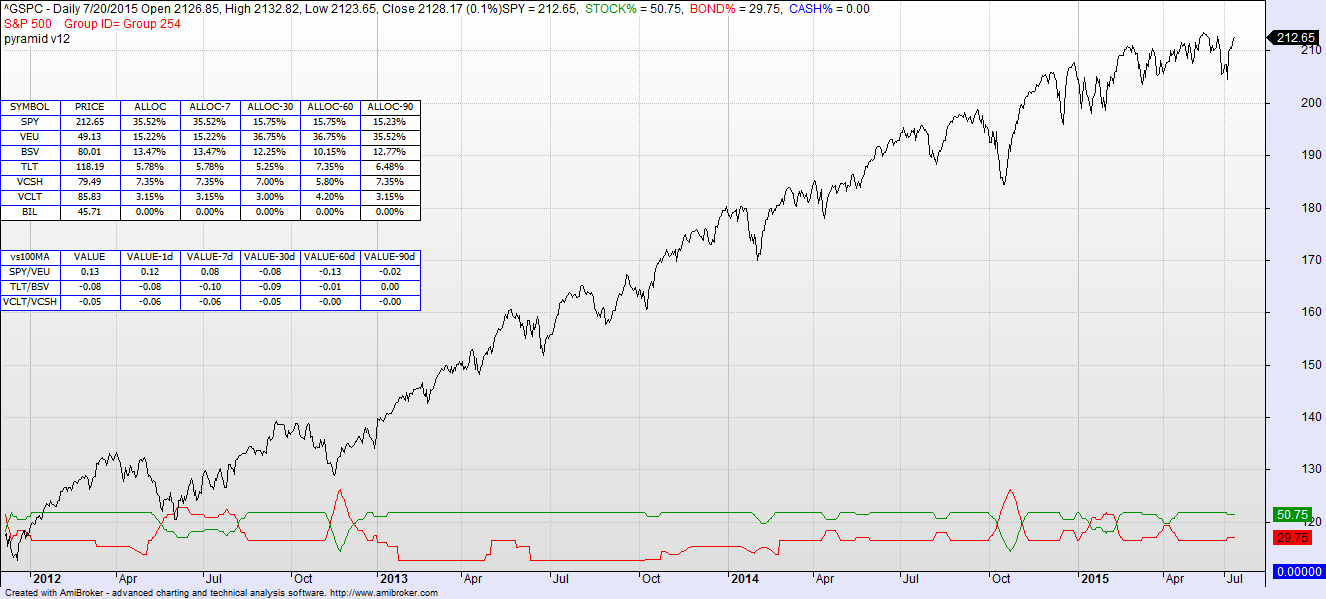

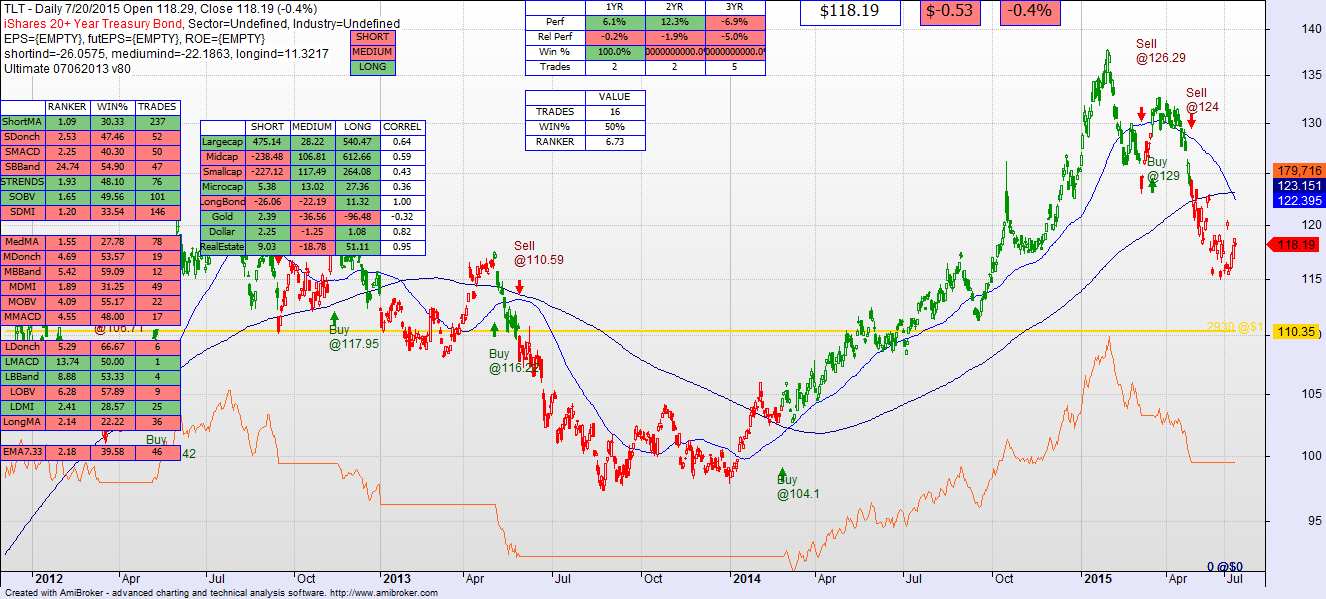

The asset/bond ratios of 52%/27% has not changed, but the market is in a consolidation, sideways phase. Now would not be the time to put a lot of new money in this market. Small caps continue bruised, midcaps a bit less so, and large caps largely sideways. This is the beginning of a classic breakdown but it has not proceeded much further in the past few weeks.