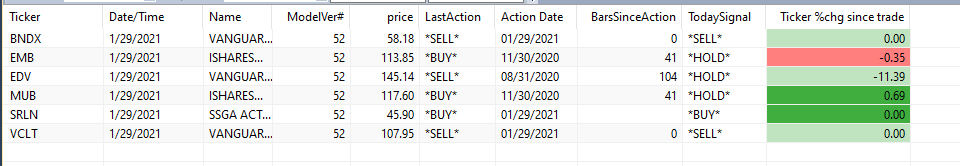

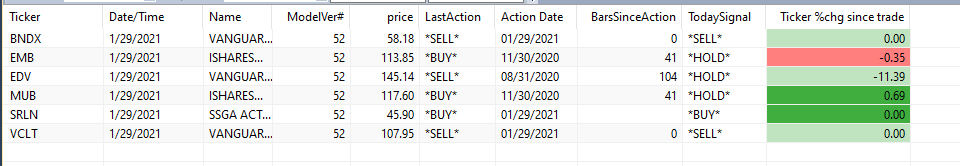

Fixed Income Status as of January 30

Note that the model suggests holding EMB – MUB – SRLN at this point.

VCLT is a SELL as of yesterday.

SRLN is a BUY as of yesterday.

BNDX is a SELL as of yesterday.

Conservative. Smart. Investing.

Note that the model suggests holding EMB – MUB – SRLN at this point.

VCLT is a SELL as of yesterday.

SRLN is a BUY as of yesterday.

BNDX is a SELL as of yesterday.

Below are listed the ETFs in our equity list and their current status.

Note that XLP is a SELL as of today.

The balance of the ETFs have performed as predicted since their last action via the model.

According to the algorithm we should be holding FDL – VNQ – XLK – XLU – XLY

Bucket 2 in the ETF Retirement Strategy is Fixed Income. For this bucket, we attempted to pick a “best in class” ETF for each of the five (5) categories:

| Morningstar /Schwab Fund Category | ETF |

| Long Government Bonds | EDV – Vanguard Extended Duration Treasury Index Fund ETF Shares |

| Emerging Market Bonds | EMB – Shares JPMorgan USD Emerging Markets Bond ETF |

| Municipal Bonds | MUB – iShares National Muni Bond ETF |

| Long Term Bonds | VCLT – Vanguard Long Term Corporate Bond ETF |

| World Bond – US Hedged | BNDX – Vanguard Total International Bond Index Fund ETF Shares |

As with the Equity ETF’s, our desire is for the asset correlation to be less then .70.

As I shared in a previous post, Mark and I have been on a journey of selecting a portfolio of ETF’s to include in the modified three bucket approach.

After various iterations and experiments, we have settled on a “Magic 8” as the Equity portion of the portfolio (our buckets 3 and 4). At the core of the eight (8) are a set of five (5) sector ETFs from George Dagnino with one substitution:

Current Projection: Model votes 5-3 in favor of Expansion over Contraction. Model favors an estimated economic Phase 2 Late Stage Expansion. This favors ETFs that are positively correlated with the overall economy.

I have spent numerous hours researching ETF’s to include in our model portfolio. As Mark has shared in other posts, we are using the “Three Bucket” approach recommended by Christina Benz with Morningstar. In her articles, she includes investments for the three buckets for a moderate and aggressive portfolios. If you are interested in the articles and unable to find them based upon Mark’s previous posts or doing Bing or Google searches, let me know and I will gladly share.

Need some additional contribution here about how to use Options to prevent big flash losses in the market. That is likely the best way to protect our downside in this monthly system.

Attached are comparison’s of the latest algorithm to two previous versions. In version 44, we attempted to replace and remove select ETF’s to see the impact. Overall Annual RoR increased from 8.34% to 8.41%.

In version 45.2, Annual RoR increased to 9.49% by Mark introducing economic indicators into the model. I will let “the Dr.” go into more detail about the changes.

For those who want to explore the data/results in more detail, I will post/share the Power BI report in the Portfolio Slicer topic area. The latest data from v45.2 is already loaded into the model. I will elaborate in more detail about the Power BI report in that post.

Attached is a customized version of the Portfolio Slicer Power BI report containing v45.2 of the trading model. Attempts to refresh will fail since the data connections point to the Excel spreadsheet and PSData folders where data from external data sources are loaded (e.g. quotes and dividends).

The first several pages are additions to v2.4 of the PBI report from the Portfolio Slicer site. Some of the original pages have been modified and others are in development… the latter should be obvious.

I am still learning the data model and the meaning of many measures and am not an expert. I know enough about Power BI and Power Query to be somewhat productive and a little DAX. If anyone has DAX or MDX experience, please let me know so I can reach out to you for assistance if/when needed.

I will attempt to answer any question and welcome requests to improve the reporting which is evolving.