https://onthemarkinvesting.com/wp-OTMcontent/uploads/2018/03/Capture.png

Conservative. Smart. Investing.

The emerging approach uses a “Bucket Strategy”. Basically, Bucket #1 is Cash, Bucket #2 is Fixed Income, Bucket #3 is Income producing Equities, and Bucket #4 are capital gains focused Equities. On an annual basis, the income from Buckets #2 and #3 refresh Bucket #1, and we use Bucket #4 to capitalize on long term market gains.

This approach has been described in an article by Morningstar. We are modifying the approach slightly to include an additional bucket.

https://www.morningstar.com/articles/840177/the-bucket-approach-to-retirement-allocation

Our analytic approach is designed to link technical investing techniques with economic data. This is described in many of the presentations by George Dagnino. We are attempting to automate this approach using the Amibroker trading software for convenience.

Dagnino’s books that we are baking into this analysis include “Easy Ways to Beat the Market with ETFs” and “Profiting in Bull or Bear Markets”.

https://www.peterdag.com/

I struggled to find 5 top picks for 2020, I was only able to come up with 2:

For a speculative pick, I still like ROKU, as it is not tied to single streaming supplier – it supports Disney+, Hulu, Netflix, just about every streamer out there. And they have their own ad-supported Roku Channel. As I said on traditional value metrics I would not pick them but I bought a small amount of shares back in 2018 at about $47, and the stock is now about $148! I still think that this stock has room to grow.

(in his own words…)

CELG – Jan 2, 2019 – 63.19, bought by BMY on Nov 25, 2019 at 108.24, 71% gain

LRCX – Jan 2, 2019 – 133.46, current price is 295.69, 121% gain

FB – Jan 2, 2019 – 128.99, current price is 206.30, 60% gain, close to my year end target of 219

https://onthemarkinvesting.com/wp-OTMcontent/uploads/2018/03/Capture.png

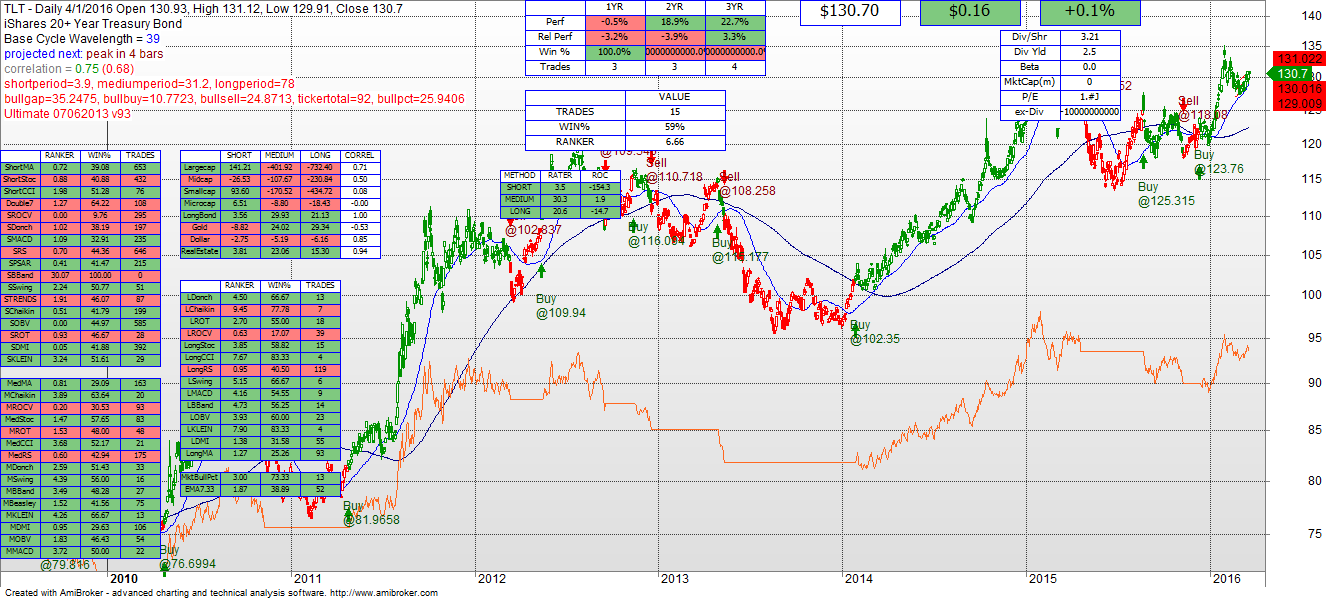

In any event, note the technical trend for Largecap, Midcap, Smallcap, Microcap, Longbond, Gold, and Real Estate in the box below. They are all BUY in all periods. That is (historically) unusual, and counter to long term correlation — as you can see by the Correl (correlation) column, these asset groups are not highly correlated yet they are all BUY in the model and generally have all been trending upwards due to the worldwide search for yield.

All of this to the point that it is about time to begin to fly the plane using Instrument Flight Rules instead of Visual Flight Rules, as it is going to start getting stormy. Data typically reverts to its mean, and in this case, at some point, these relationships are going to begin to diverge back to historic patterns.

I have been preparing for such a thing in the model and will be issuing updates appropriately. If you have a particular security that you’d like a snapshot on let me know.

Mark

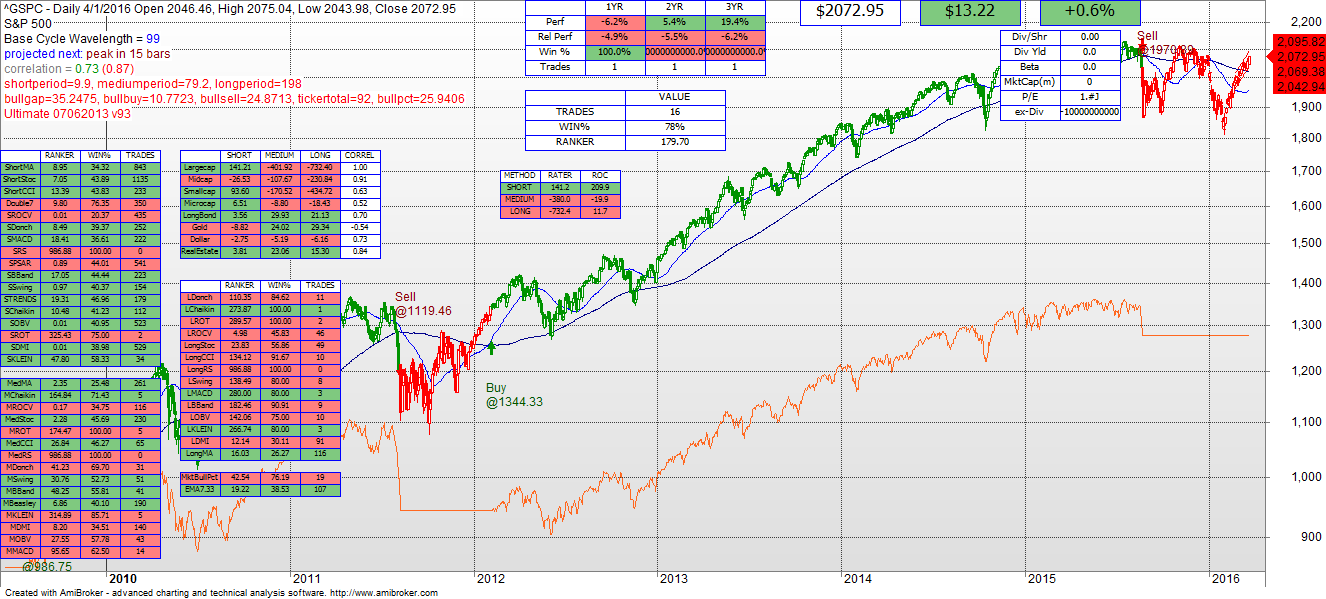

Based on daily closing data however we continue to be out of the market, selling at 1970 and yes being out during the last run-up, as well as out during the interim drops to as low as 1850. This model is designed to be intermediate term, and it is biased against large draw downs. So the trend will have to fully reestablish before it will bring you back into this market. Historically it has a 78% win percentage and I believe that over time it will be useful.

The long bonds had a buy signal at 123 and are presently at 130. There is near term volatility with every word out of the Fed, but for the moment it still makes sense to hold bonds for their relative predictability.

I have begun to experiment with adding market wide breadth and other indicators to the model including Bullish Percentage, which in one flavor is the percentage of S&P stocks that are bullish based on Point and Figure charting. I expect that this should further improve the intermediate and long term results.