Year: 2021

AAII Guidance on Placing Stock Orders

The following is guidance from the American Association of Individual Investors about how buy and sell orders should be placed:

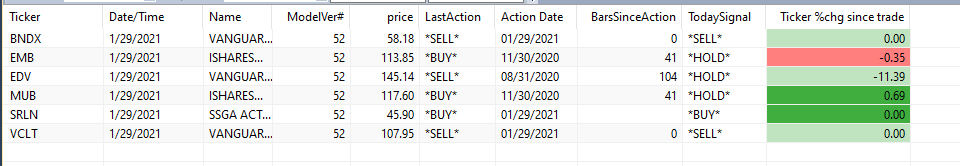

Fixed Income Status as of January 30

Note that the model suggests holding EMB – MUB – SRLN at this point.

VCLT is a SELL as of yesterday.

SRLN is a BUY as of yesterday.

BNDX is a SELL as of yesterday.

Equity Status as of Sat January 30

Below are listed the ETFs in our equity list and their current status.

Note that XLP is a SELL as of today.

The balance of the ETFs have performed as predicted since their last action via the model.

According to the algorithm we should be holding FDL – VNQ – XLK – XLU – XLY

Fixed Income ETF Selection

Bucket 2 in the ETF Retirement Strategy is Fixed Income. For this bucket, we attempted to pick a “best in class” ETF for each of the five (5) categories:

| Morningstar /Schwab Fund Category | ETF |

| Long Government Bonds | EDV – Vanguard Extended Duration Treasury Index Fund ETF Shares |

| Emerging Market Bonds | EMB – Shares JPMorgan USD Emerging Markets Bond ETF |

| Municipal Bonds | MUB – iShares National Muni Bond ETF |

| Long Term Bonds | VCLT – Vanguard Long Term Corporate Bond ETF |

| World Bond – US Hedged | BNDX – Vanguard Total International Bond Index Fund ETF Shares |

As with the Equity ETF’s, our desire is for the asset correlation to be less then .70.

Equity ETF Selection

As I shared in a previous post, Mark and I have been on a journey of selecting a portfolio of ETF’s to include in the modified three bucket approach.

After various iterations and experiments, we have settled on a “Magic 8” as the Equity portion of the portfolio (our buckets 3 and 4). At the core of the eight (8) are a set of five (5) sector ETFs from George Dagnino with one substitution:

January 29 2021 Economic Analysis – Model Version 52

Current Projection: Model votes 5-3 in favor of Expansion over Contraction. Model favors an estimated economic Phase 2 Late Stage Expansion. This favors ETFs that are positively correlated with the overall economy.

Retirement Strategy Portfolio – ETF Selection Process – Overview and Introduction

I have spent numerous hours researching ETF’s to include in our model portfolio. As Mark has shared in other posts, we are using the “Three Bucket” approach recommended by Christina Benz with Morningstar. In her articles, she includes investments for the three buckets for a moderate and aggressive portfolios. If you are interested in the articles and unable to find them based upon Mark’s previous posts or doing Bing or Google searches, let me know and I will gladly share.

Options for risk management

Need some additional contribution here about how to use Options to prevent big flash losses in the market. That is likely the best way to protect our downside in this monthly system.