The linking of economic cycles with the technical investing algorithms is an important part of our ETF algorithm. The model has been updated to Version 53 to include refined economic criteria.

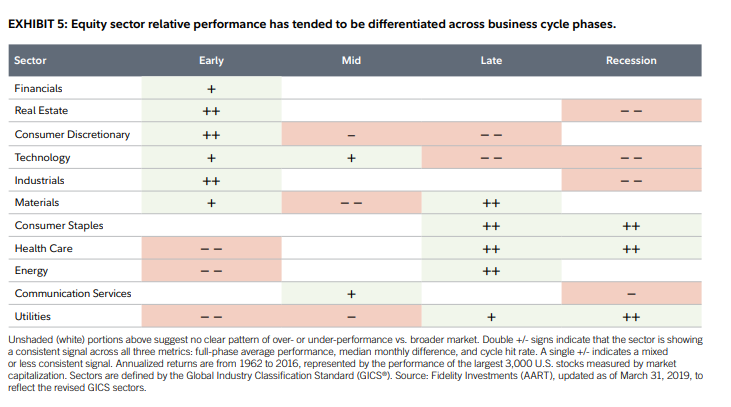

In Version 53 the trade entry logic was further refined using an analysis that was conducted by Fidelity Investments and summarized in the table below. As a result of this refinement the backtesting results (1/1/2003 – current period for our target ETF securities) for the algorithm have improved slightly:

| V52 | V53 with Fidelity study | |

| RAR | 8.76% | 8.85% |

| Exposure % | 41% | 42% |

| Trades | 355 | 364 |

| Average bars held | 135 | 134 |

| Maximum Drawdown % | -10.21% | -9.42% |

The refinement only affected the Entry, so the average bars held is roughly the same. We are initiating fewer ETF trades in the “wrong” economic period, so return should improve and the likelihood of large losses should be less, hence the reduction in MaxDD. While the results did improve slightly, the results tend to show that the previous Dagnino economic criteria were generally sound.

Version 53 replaces the current Version 52. Version 53 will be run at February month end during the normal monthly refresh of guidance.