Prior Week Market Performance:

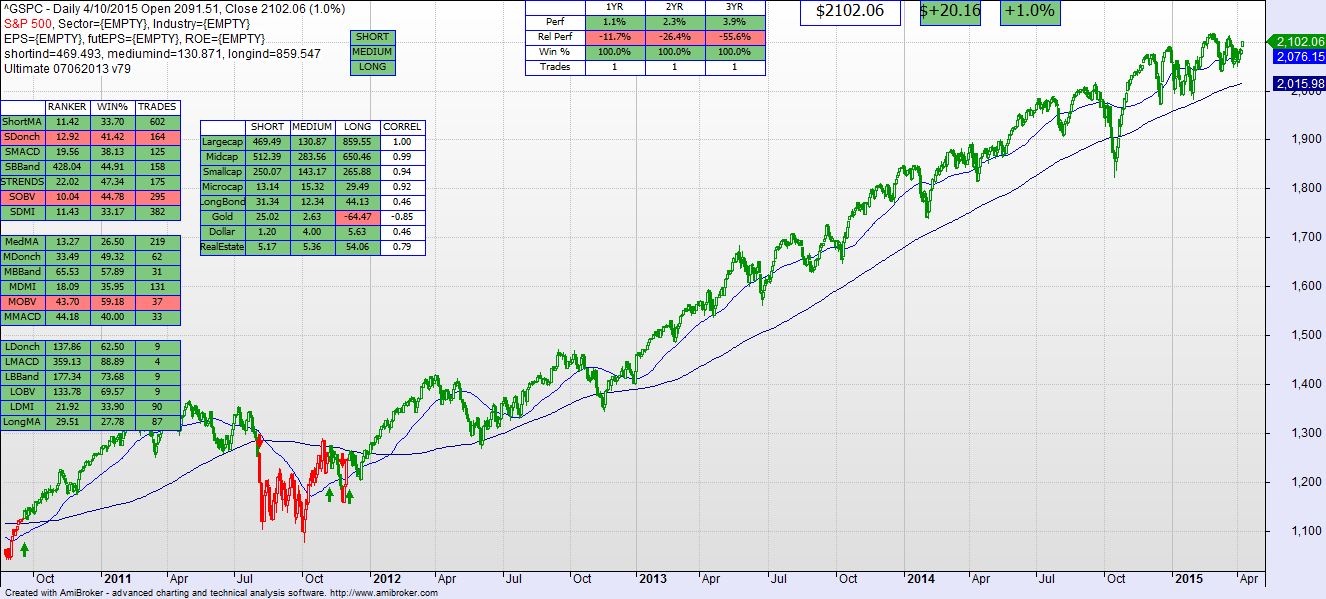

- The S&P large caps gained 1.7% last week to 2102.06.

- The Russell 2000 small caps gained 1.7% last week to 1264.77.

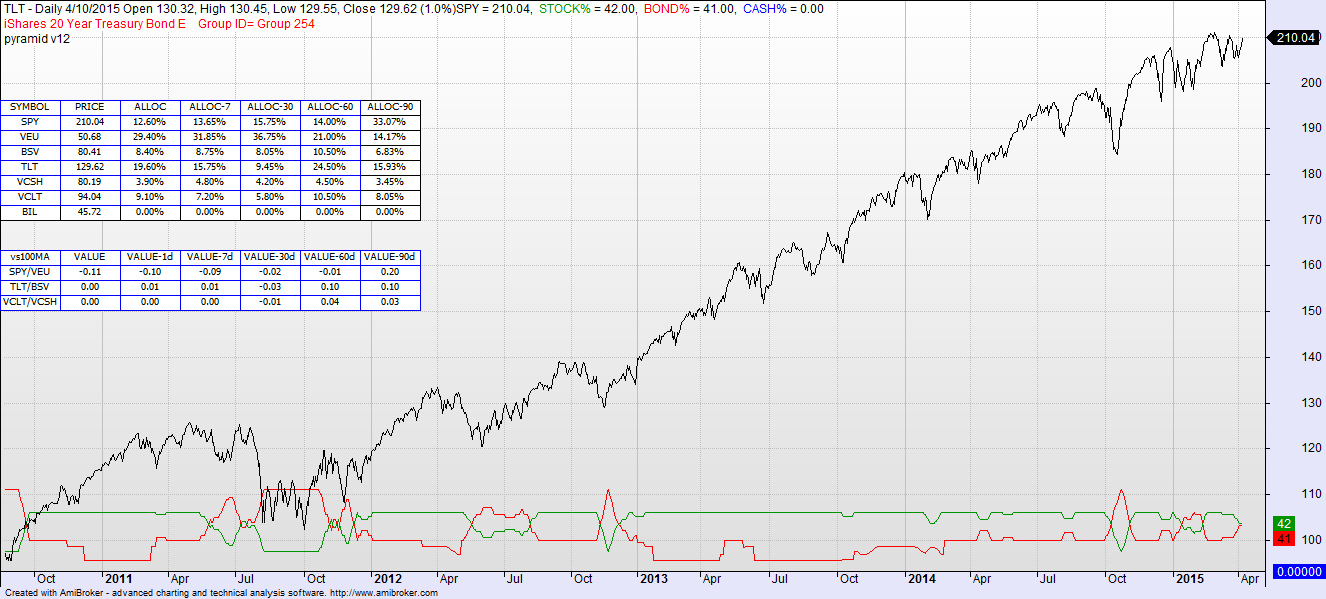

- Long Bonds (TLT) lost 0.8% last week to 129.62.

- Asset Allocation Model: Stocks (dropped to 42% from 47.25%); Bonds (rose to 41% from 34.25%); Discretionary (11.75%)

Last Commentary (Two Weeks Ago): The market dropped a bit last week and large caps shifted to SELL, but there are reasons to only light the inquiry sign and not overreact. Again only an indication of fraying, and a reason to light the “Inquiry” sign (as they say in Kentucky), but not a reason to panic.

Current Technical Model Indicators (Short, Med, Long periods):

- Large Cap S&P 500 – BUY, BUY, BUY

- Mid Caps – BUY, BUY, BUY

- Small Caps – BUY, BUY, BUY

- Micro Caps – BUY, BUY, BUY

- Long Bonds – BUY, BUY, BUY

This Week’s Commentary: The long and medium term trends are still intact, but I would expect this upcoming week to be a down week in the market. A few technical indications:

- The S&P has been in a sideways phase since early February, oscillating between 2040 and 2120. It is now at 2102, or 81% of the way toward the cycle top. Given the cyclical pattern, the index will begin to revert back toward the center of the cycle probably this week.

- The VIX is at 12.58, also near an 8 month low. The 50 and 200d MA are both around 15, and the traditional VIX is even higher, so given mean reversion you would see investor anxiety increase a bit and the VIX move up.

- The asset allocation in the Portfolio is now roughly 50-50 stocks versus bonds. This increased weighting toward bonds is a reflection of the sideways S&P relative to the upward movement in the intermediate bond index, which has gained 50% more this year than the S&P as a whole.

- Even in this time of a low VIX and very little return in bonds, bonds continue to competitively perform relative to the market overall. Any decrease in investor confidence will put the brakes on Fed interest rate actions, increase the VIX, and improve bond prices. The bet that Fed actions will cause short term trouble in the long term bond market is very real, but its timing continues to be a big question mark.

If you are strictly intermediate or long term, there is nothing to see here, although if you are heavily weighted in equities you may want to hedge a bit into bonds.