For some time now the technical model has advocated being 75% in cash/bonds and a max of 25% in market-correlated equities. Just a review:

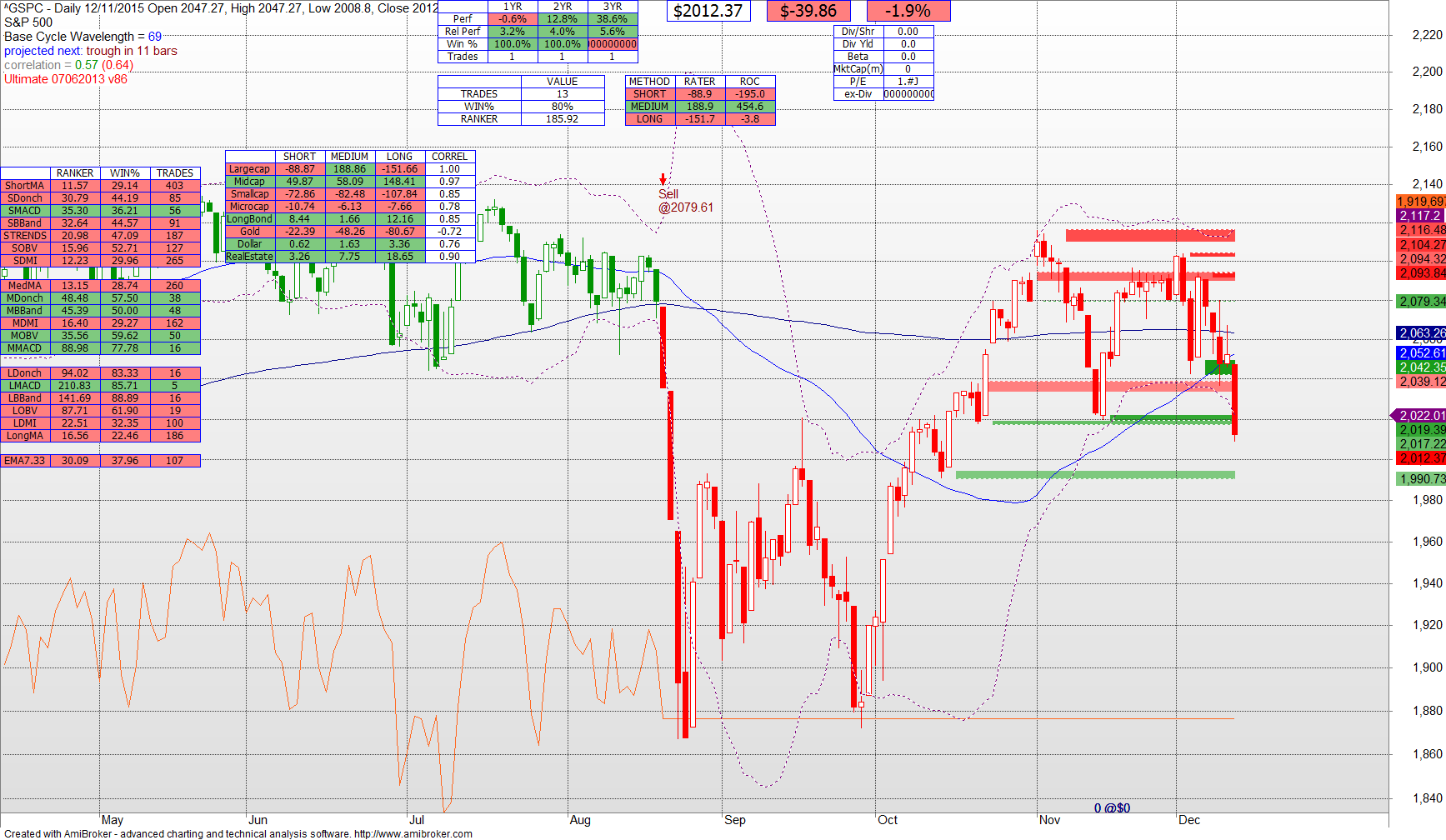

August 27: S&P at 1987. Allocation recommended at 75% bond / 25% equity.

September 9: S&P at 1942. Recommend 75/25 bonds.

November 1: S&P at 2079. Still recommending 75/25 bonds.

December 13: S&P at 2012. Still recommending 75/25 bonds.

You can see that things have become more volatile, but for the intermediate term investor (not the short term trades) there has been no compelling reason to re-enter this market long. Even when the technical indicators have improved since August they have been spotty. And all the while the Microcap and Smallcap indexes have not improved, indicating a leading weakness.

I continue to run the technical model daily and while there have been few updates it is only because there has been no change to the intermediate term mix.