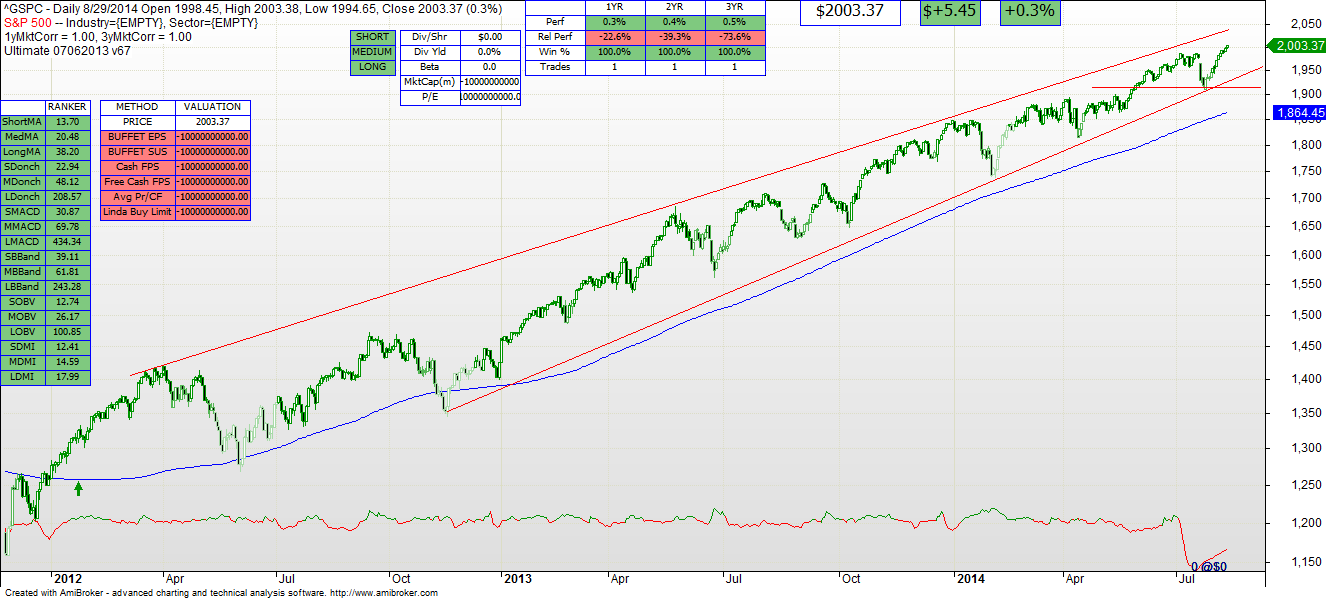

Short, Medium and Long term indicators for the S&P 500 are all favorable. The index itself is in the middle of an up channel.

Currently the S&P is at 2003. The channel ranges from 1925 to 2050. So there are 47 points above and 78 points below the current index value in the channel. I would prefer a 2:1 ratio of upside potential to downside potential. At a ratio of 47:78 we do not have that 2:1 target. So I would wait for a slight pullback to put any additional monies into equity index funds or ETFs.