In a post in SeekingAlpha on January 27th of this year (https://seekingalpha.com/article/4401277-market-and-earning-cycles-point-to-pause-in-2022 George Dagino wrote:

“The last bottom of the business cycle took place in March 2020. Growth should therefore show a peak in 2022, assuming the upward leg of the cycle is two years. This should be also the time growth in earnings will begin to slow down.

The bottom line is the bull market is likely to continue for another twelve months. The strategic implication is it may be advisable to review the strategy based on growth and high beta investments toward the end of 2021. At that time, it may be prudent to and revisit the defensive strategy so successful during the 2018-2020 down leg of the business cycle.

Disclosure: I am/we are long SPY.”

This is not relevant because I believe everything that Dagnino says, although I generally agree with his techno-econometric view of the market. But because we have designed our algorithmic method to be a technical model linked to FED economic data, it is an interesting observation. We too are long on this market — at this moment. But our model is a 5-3 vote Expansion versus Contraction.

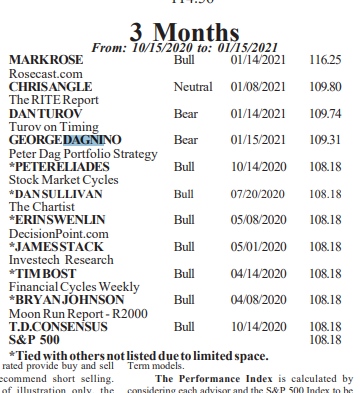

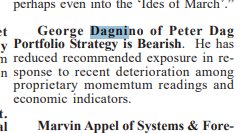

Dagnino is also leery of this market, but his portfolios have performed well in this market, judging by the most recent Timers Digest reporting for January 18 2021 where he is ranked third in the past 3 month period. But his quote in that Timers Digest edition is also revealing — like us, he is seeing deterioration in economic trends. If you are going long in this market, be careful and be prepared to reverse course as needed.