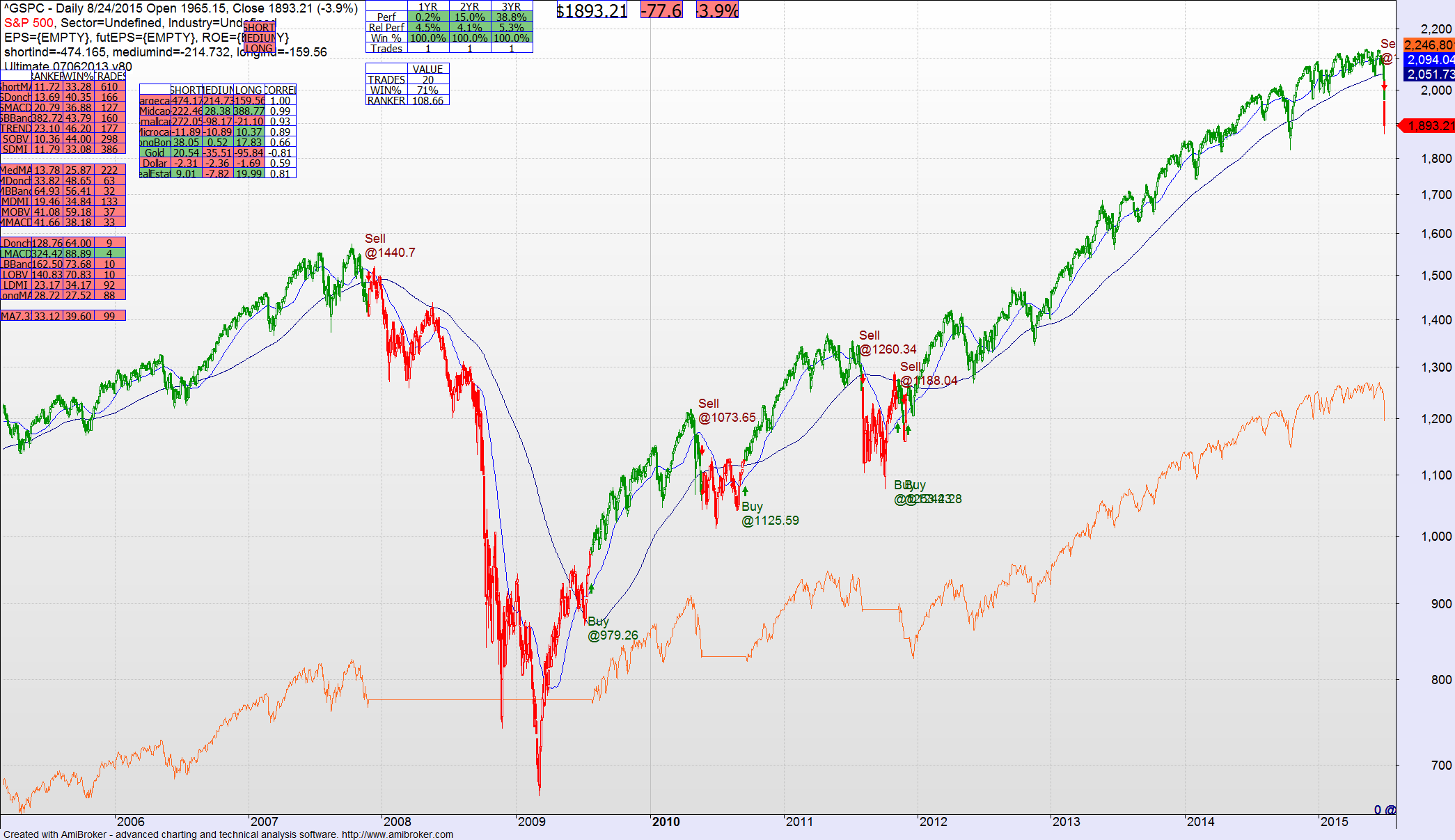

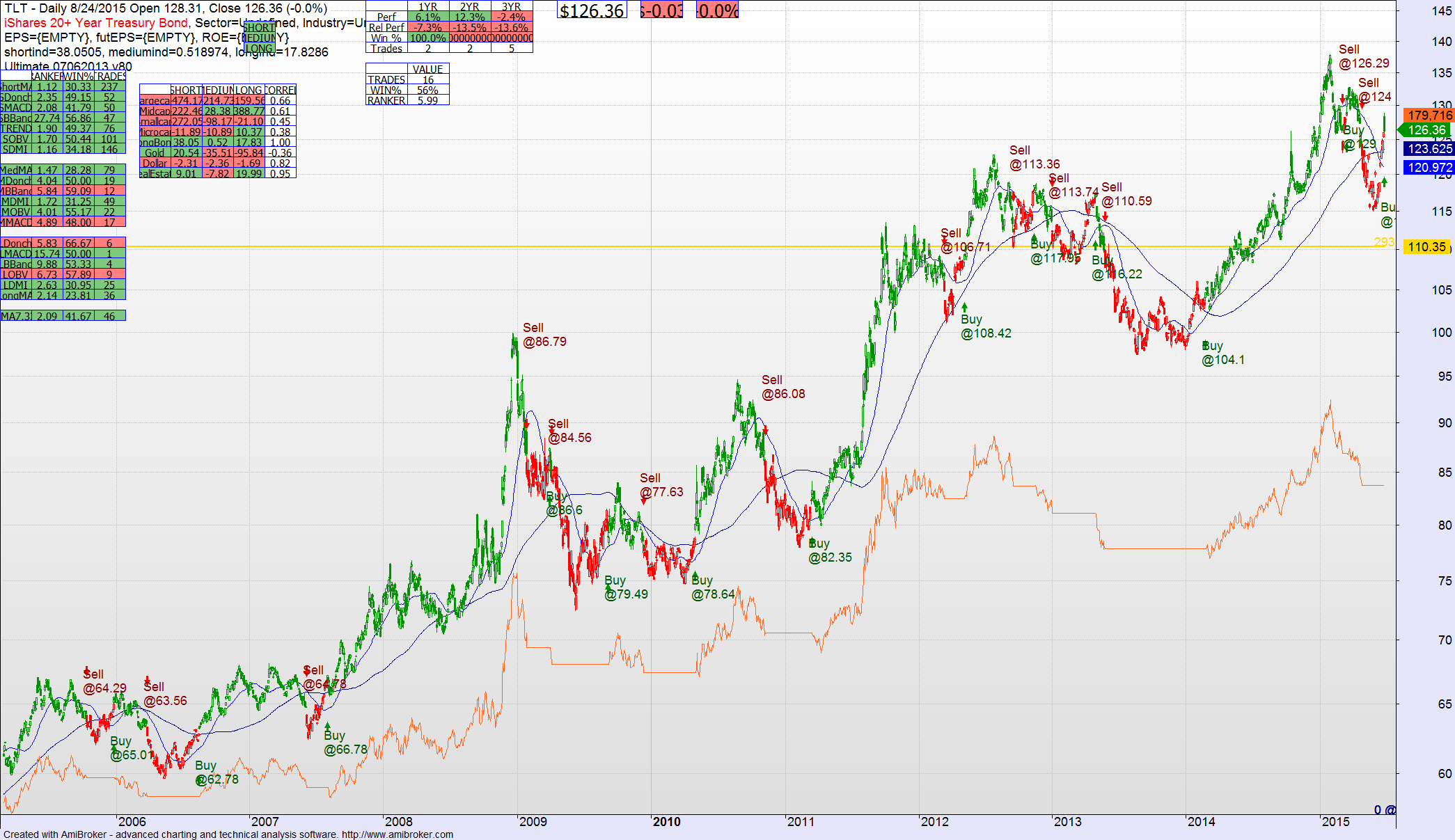

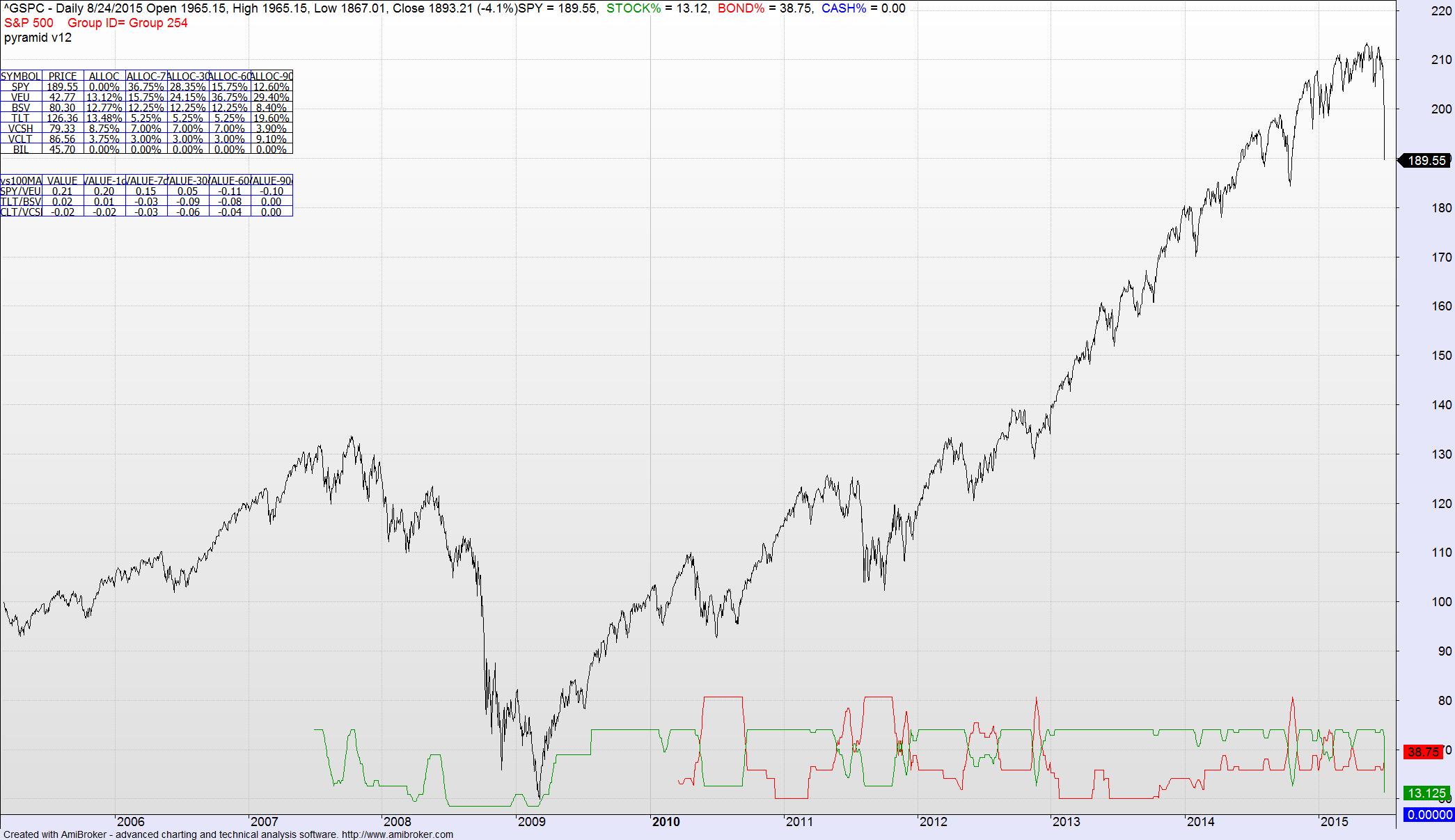

Lets start with the facts….the technical model has flashed a SELL sign for the long term S&P holder (the first since 2011) and the asset model has equities target at 13% of total holdings. So both separate technical models are advocating taking a cash-centric, conservative position.

Those of you with some diversification saw a drop today less than the -3.9% of the S&P. But enough to get your attention. Especially given the pretty scary intra-day movement.

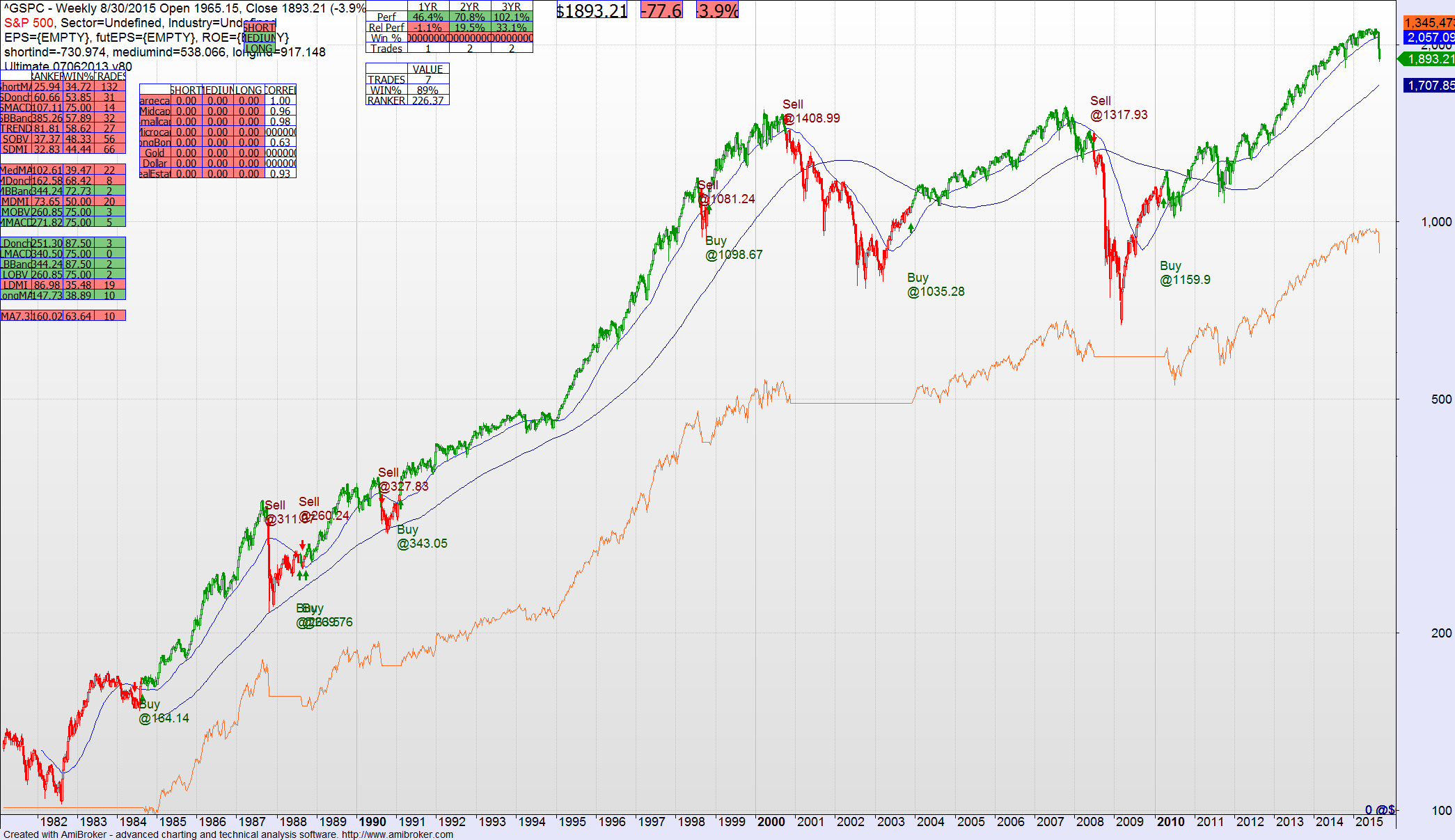

So….how fast to run to safety? Below is my current technical model but set to run on a “weekly” basis rather than using daily numbers. It has called the big drops accurately, but did not “bite” on the intermediate downward adjustments that we’ve been through since 2011 or the drop today. So far it is not at SELL — in fact it is only a short term SELL for the S&P 500.

I personally am diversified enough (and maybe stupid enough) to believe that the bottom won’t tumble out of this thing tomorrow. I prefer to sell into a rising market, and not to panic. If the model says to sell I prefer to take my time over a period of days and get a good price, rather than literally assume that the model means the end of the world is tomorrow.

It is Monday night and I am a long term investor. Playing this a day at a time but right now I am sitting tight to see what tomorrow brings. If the market rises I sit tight. If it falls some more right away I still sit tight because there is no need to panic.

Mark