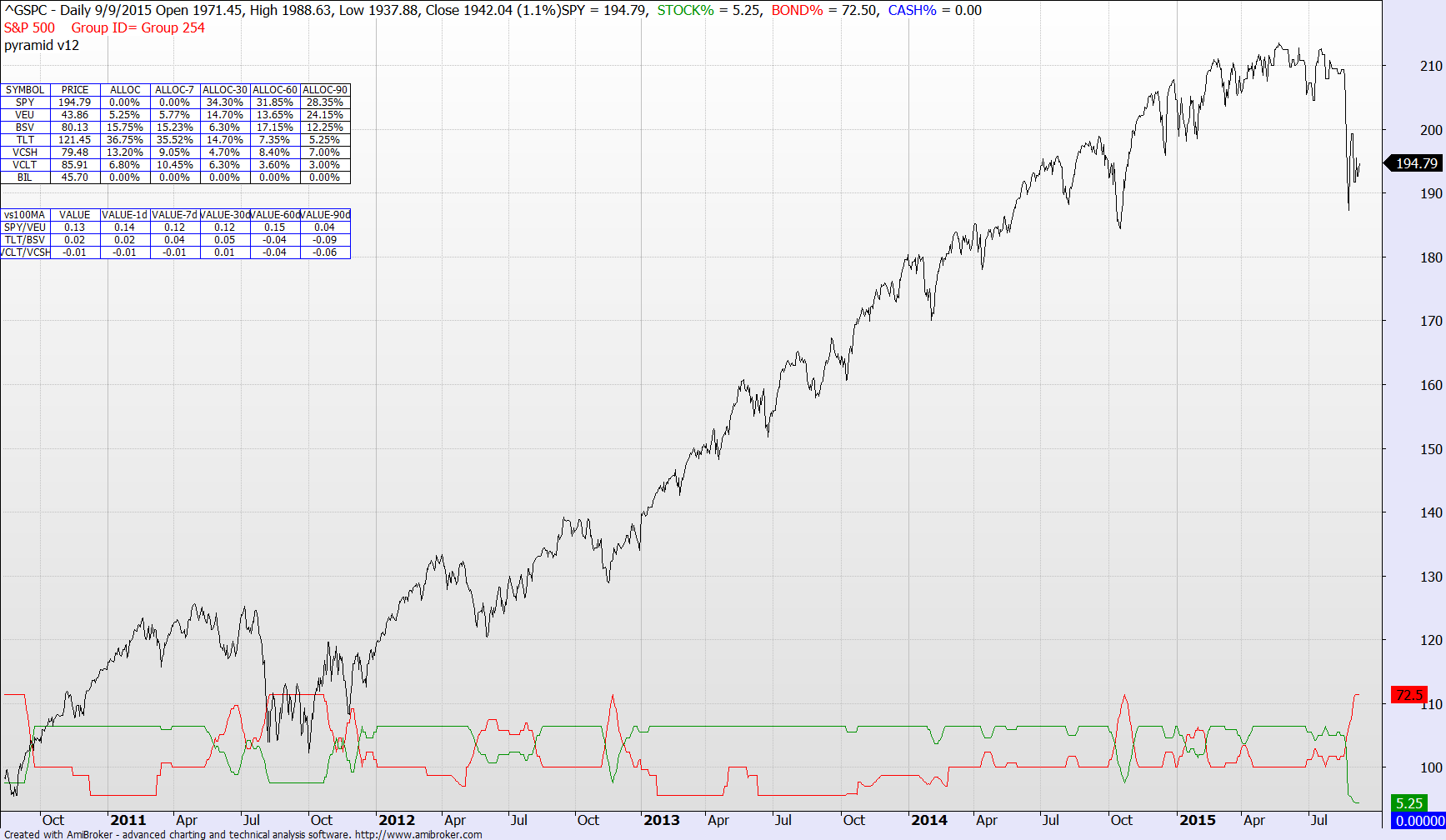

The technical S&P model is running 3.2% better than the real S&P in the past 12 months, beating it in the one, two and three year periods. Current suggested equity allocation is at 5.25% with a 72.5% suggested Bond allocation.

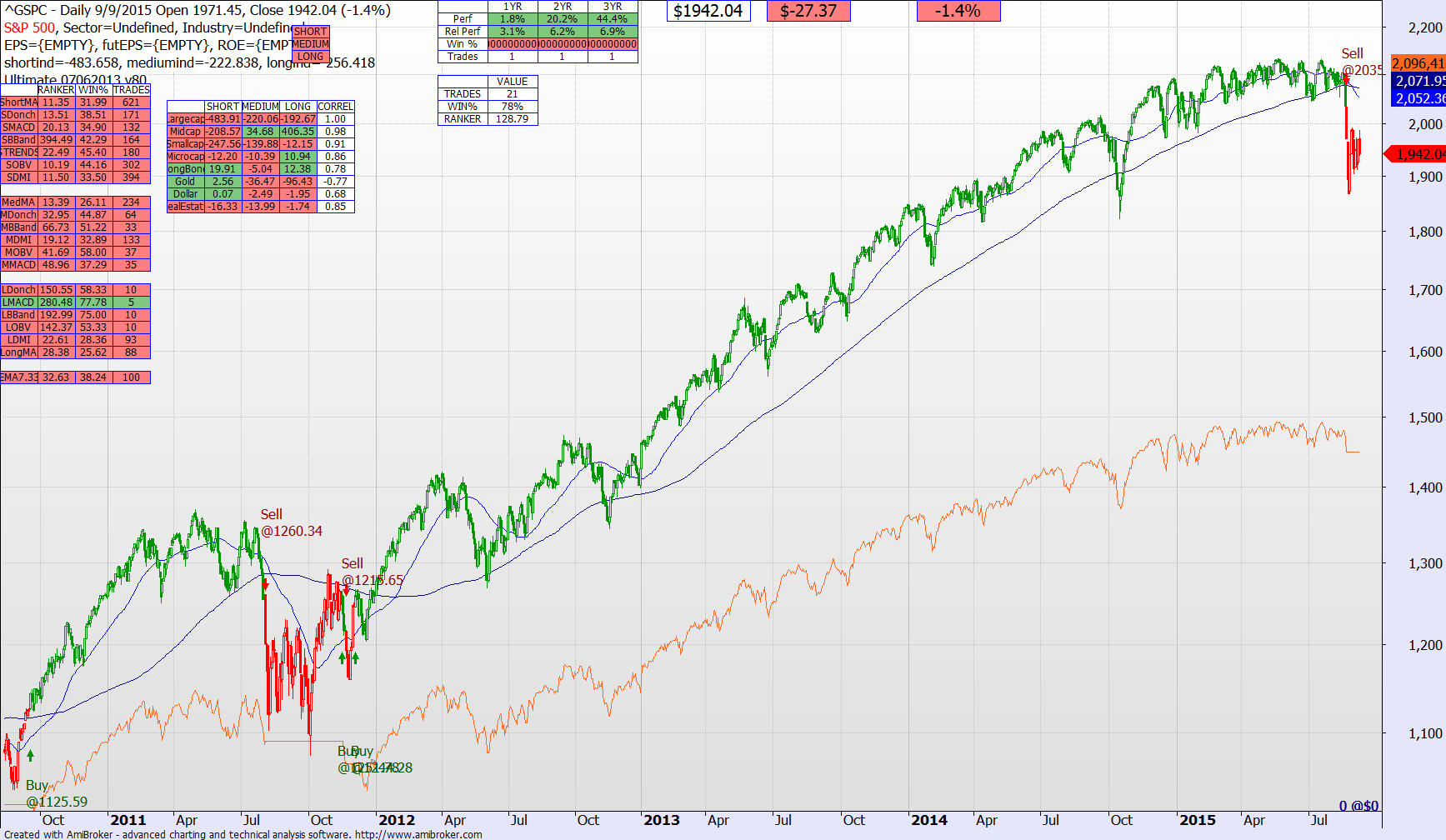

This market is frothy, looking for direction, with volatility that is a bit unusual. As an Intermediate term investor there is still not much to like here. When you see the opportunity to make money with 3 to 1 or better odds upside to downside, then jump in. Until there is some direction to this market, the odds are just not with the longer term buyer for broad index equities in this market today.

You don’t have to be in the market all of the time. Wait this out until it finds its feet, down or up.