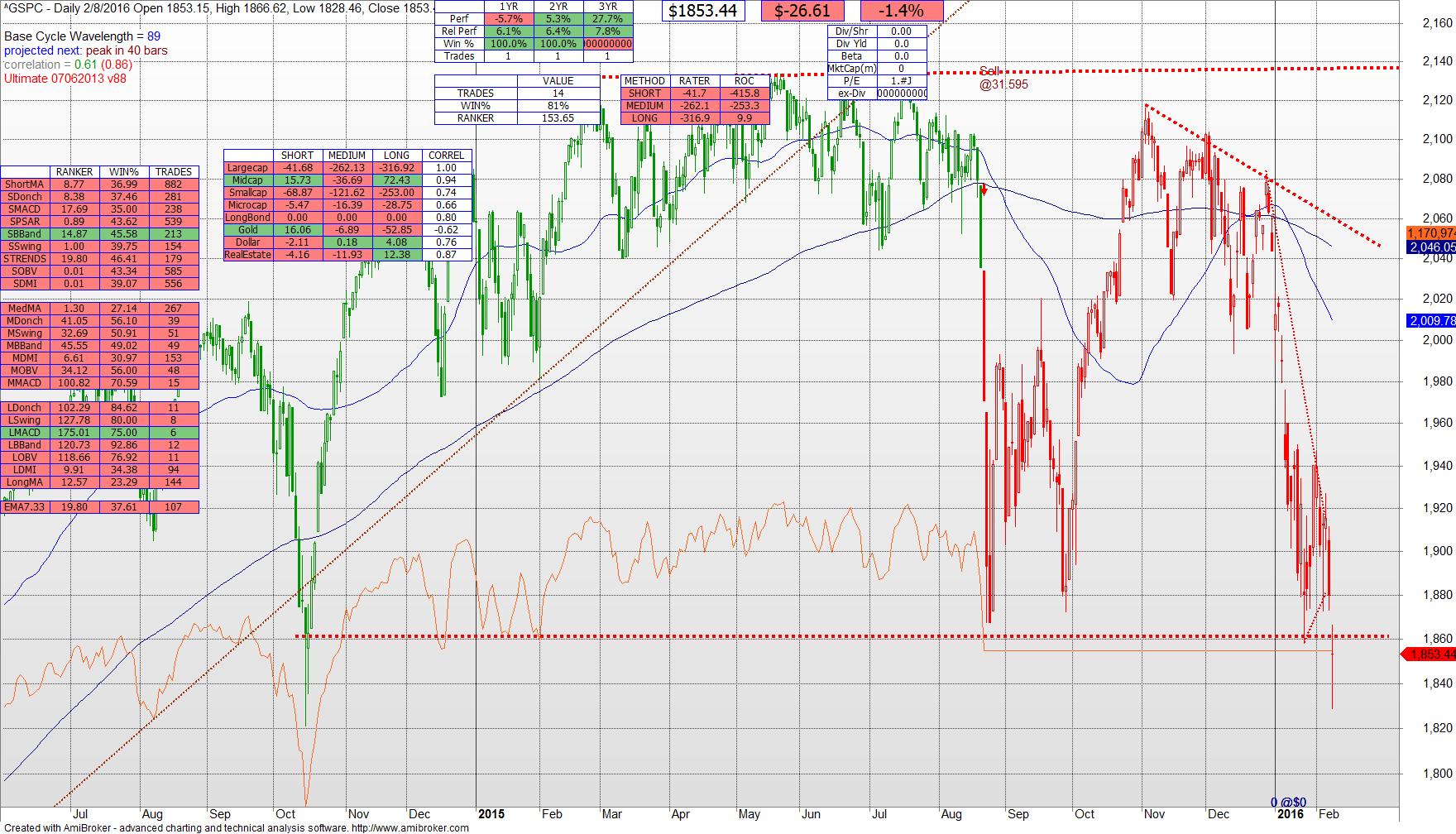

The advice from the January 17 post is still in effect. As the S&P 500 toys with 1880 (it closed at 1853 today) you should prepare for a material drop if that 1880 level does not hold. By now you should only have a small equity position.

As has been noted by others, there is an ominous piercing of the neckline of a head and shoulders setup in four different S&P 500 time frames, including daily and weekly. This market may rise again beyond 1880 but as I said last month the risk/reward is simply not worth it. If you have not yet positioned yourself for a material downside drop you should do so, with the idea that this market may climb again back above 1880 and even as high as 2040 but this chart looks like we are on our way down in the intermediate term.

The model is 6.1% ahead of the S&P500 in the trailing 12 months, 6.4% in the trailing 2 years, and 7.8% in the trailing 3 years.

The DOG S&P inverse ETF has not yet fired to a BUY, but for those interested in being aggressive it is BUY in the short and medium terms. Note that this market may come back up to “kiss the trend line” before it fades so you may be early but you likely won’t be wrong.