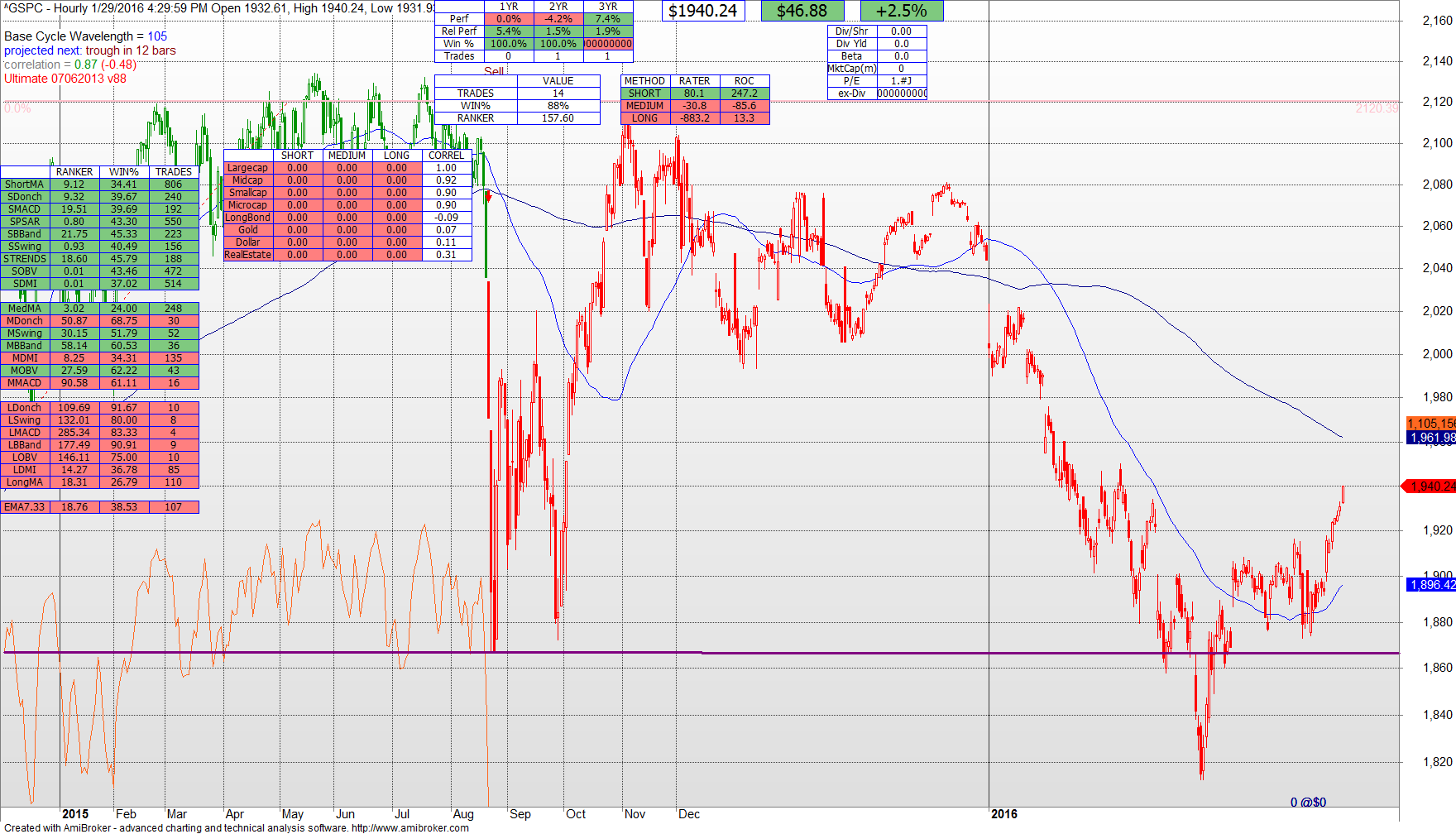

As noted in prior posts the 1880 mark for the S&P (which is currently at 1940) has proven an important measure. When 1880 holds there is always the likelihood that we might see another leg up in the market. If 1880 fails there is almost certainly going to be a material collapse to the downside.

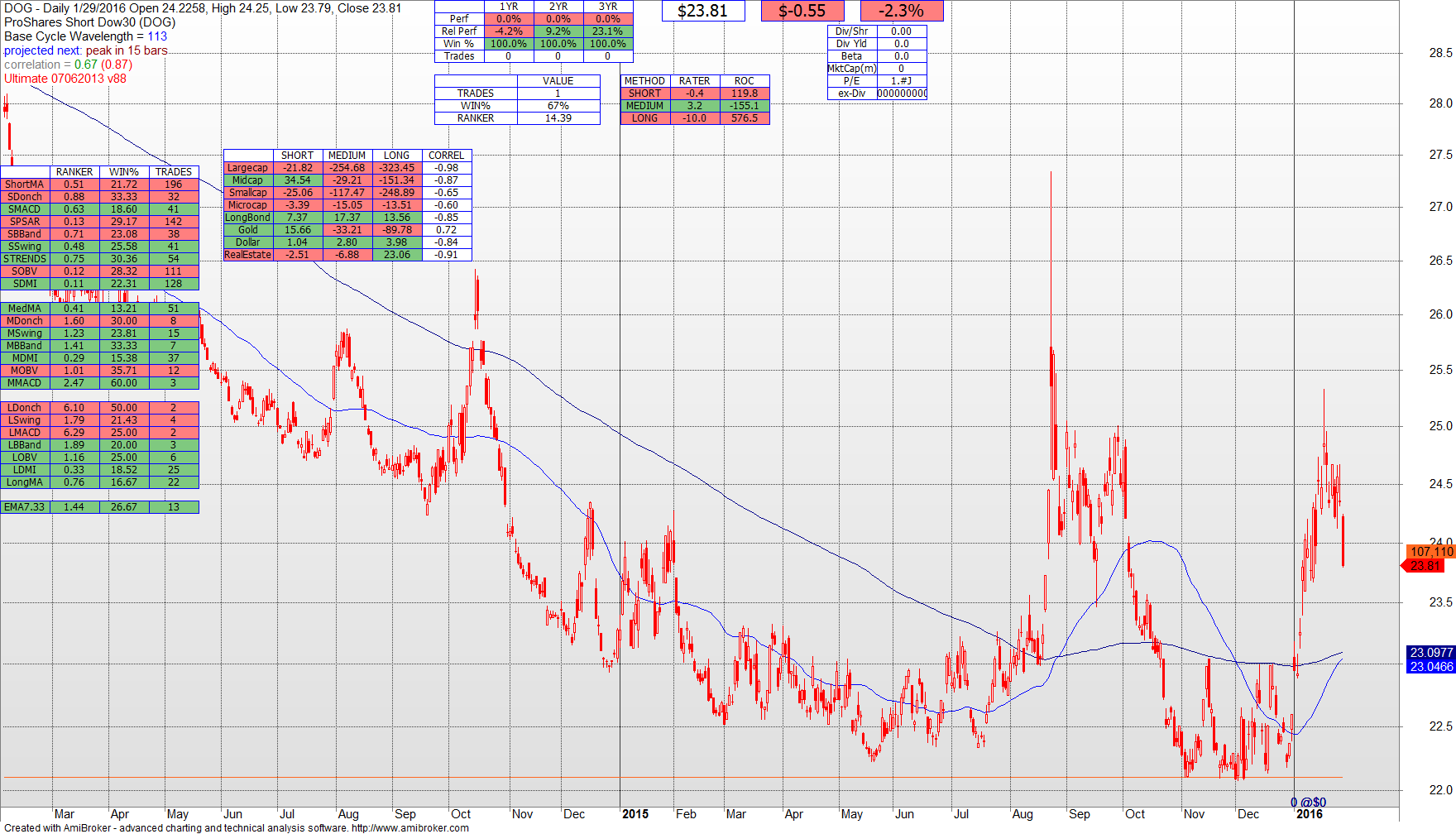

The S&P bounced off of 1880 and is now at 1940. Intermediate and Long term indicators are still leading downward, and for that reason today I include a look at DOG, which is the S&P Inverse ETF. While not yet a BUY it represents an opportunity to make money in a bear market for those Intermediate term investors whose assets are already properly allocated. When DOG fires a BUY I will pass that along in an update.

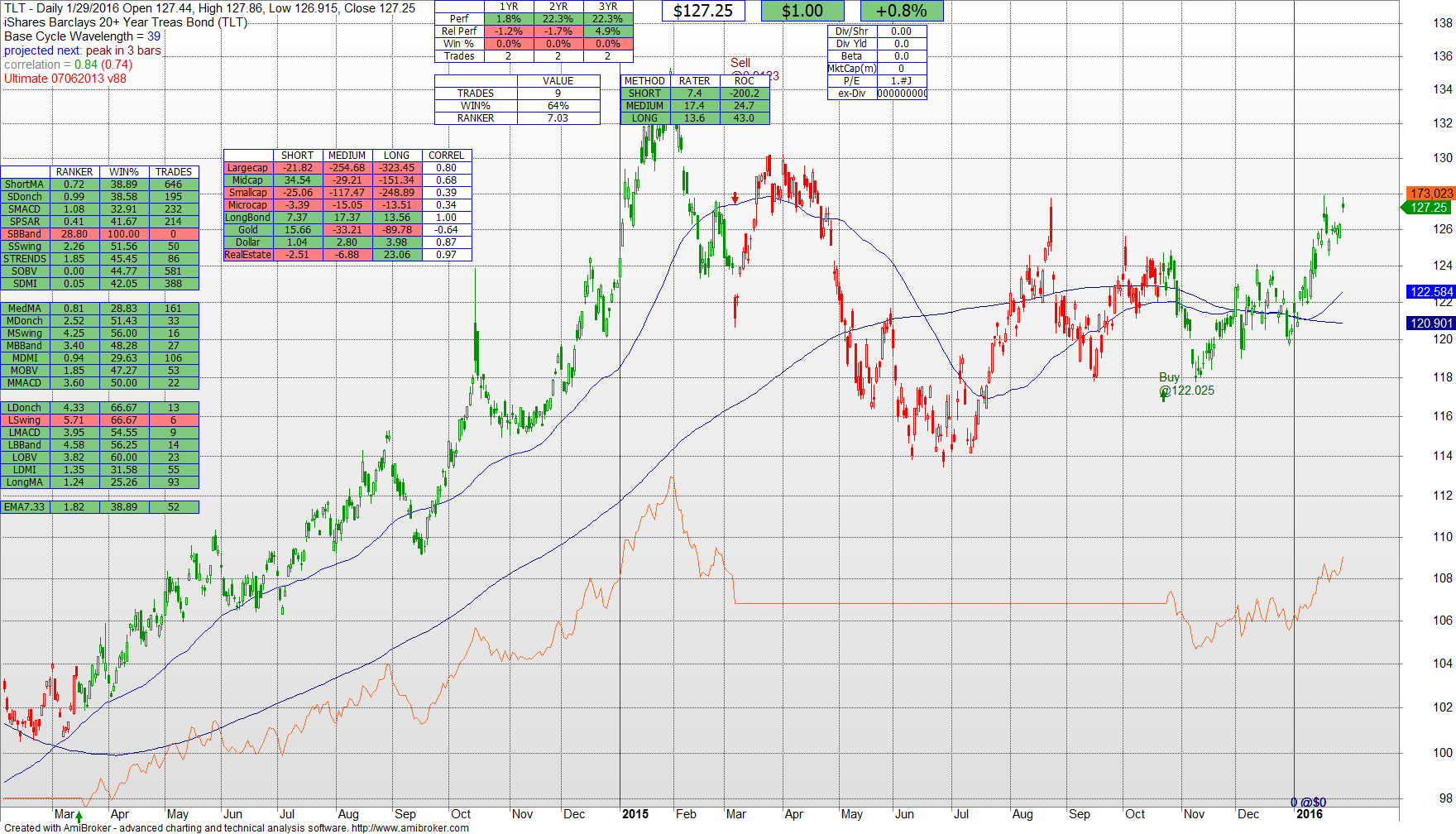

The S&P was down 5.1% in January. TLT (long bonds) were UP 5.5% in January not including the associated dividend income. This again stresses the importance of asset allocation. We continue to be about 80% Fixed / 20% Market as we wait for this relative volatility to pass and reveal a trend that intermediate term investors can capitalize upon.