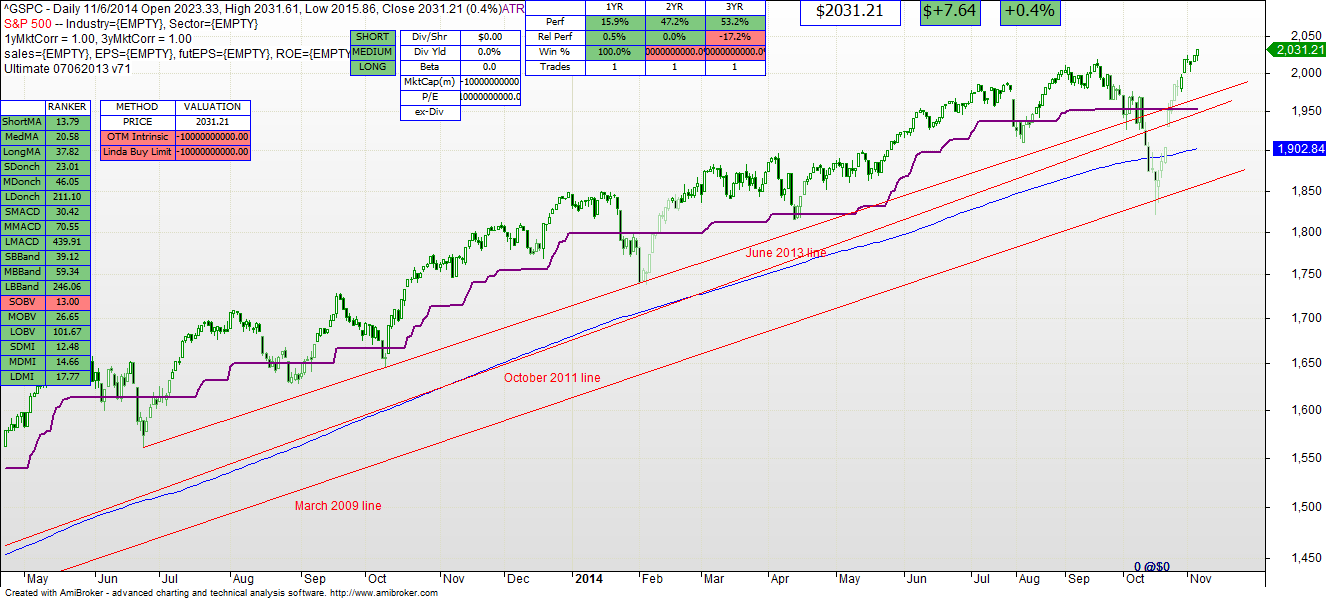

- The S&P gained 0.9% last week, rising to 2031.21.

- The Russell 2000 lost 0.2% last week, falling to 1171.86.

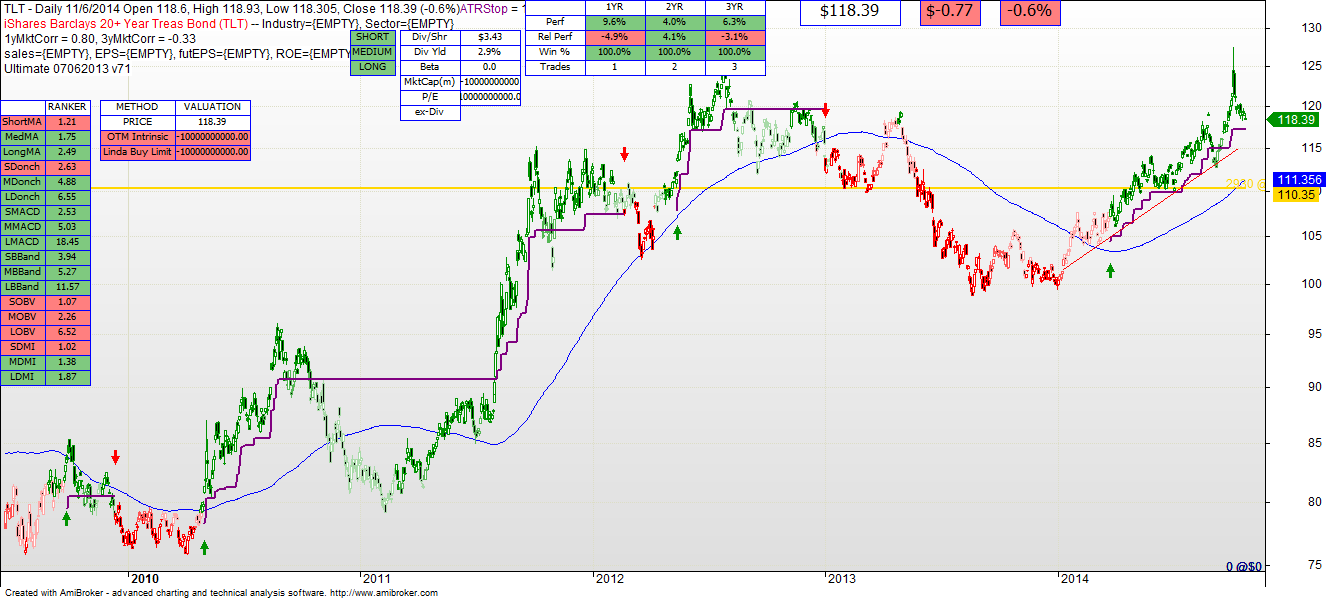

- Long Bonds (TLT) fell 0.7% last week, falling to 118.39.

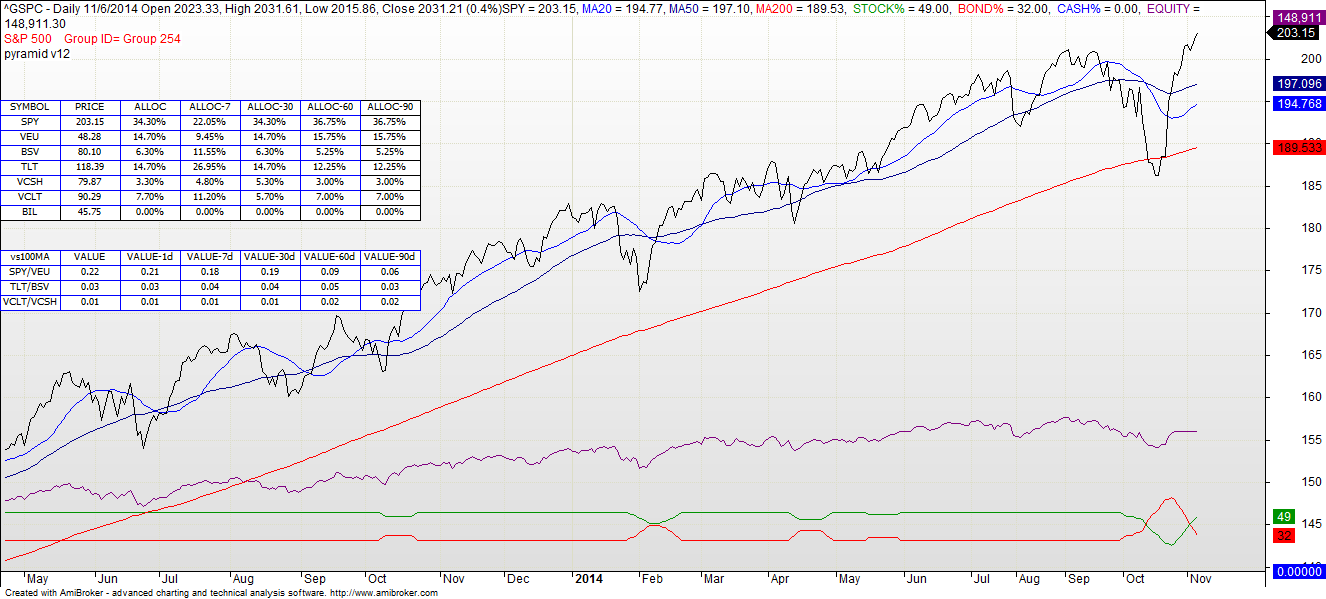

- Asset Allocation Model: 50% stocks, 30% Bonds, 20% Optional.

At this time the technical models for the S&P, Russell 2000, and Long Bonds are all BUY. The Asset Allocation model has recovered back to 50% stocks. The underlying market strength that has propelled the S&P 500 all year long has driven the market back above all of the long term trend lines dating back to the beginning of the rally in 2009. I discussed as recently as last week the breakdown in small stocks, and the divergences between the major market index and what was happening to underlying stocks. This has been a familiar story for much of 2014, so too is this advice: follow the quantitative models, which have been correctly positive on the market as well as long term bonds for quite some time now. The November-December period is traditionally a strong period for the market, which no doubt is fueling some investor confidence. I don’t like the underlying divergences, but as the indexes are going up and the models say BUY, who am I to argue?