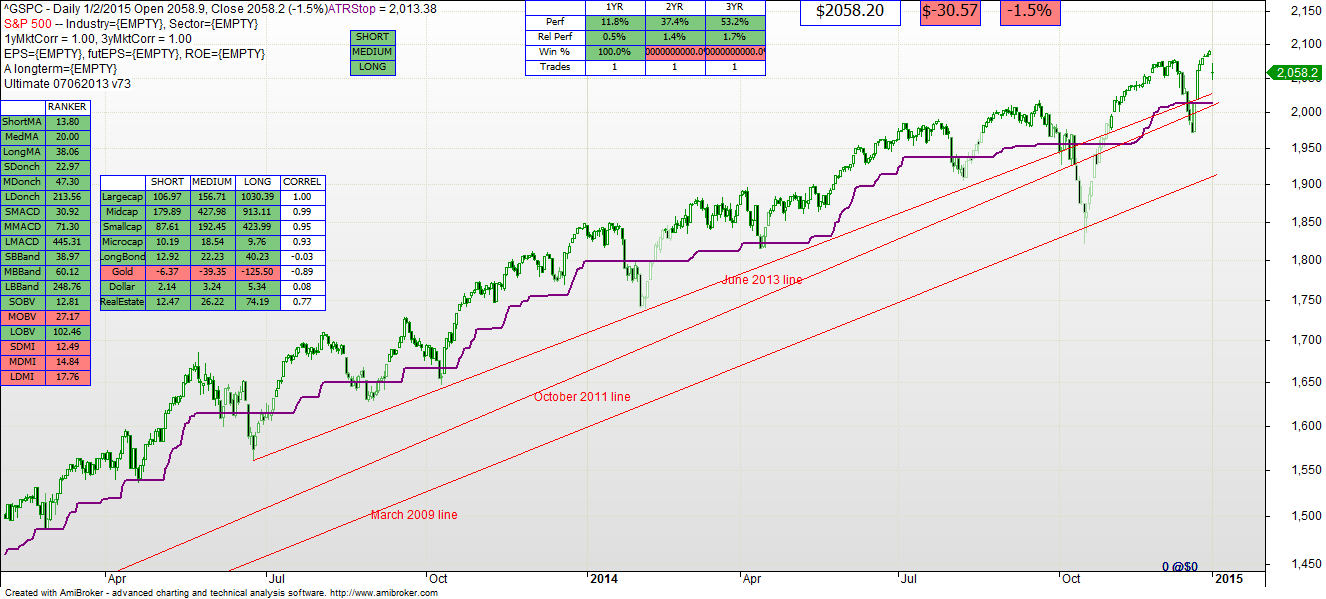

- The S&P large cap index lost 1.5% last week to 2058.20.

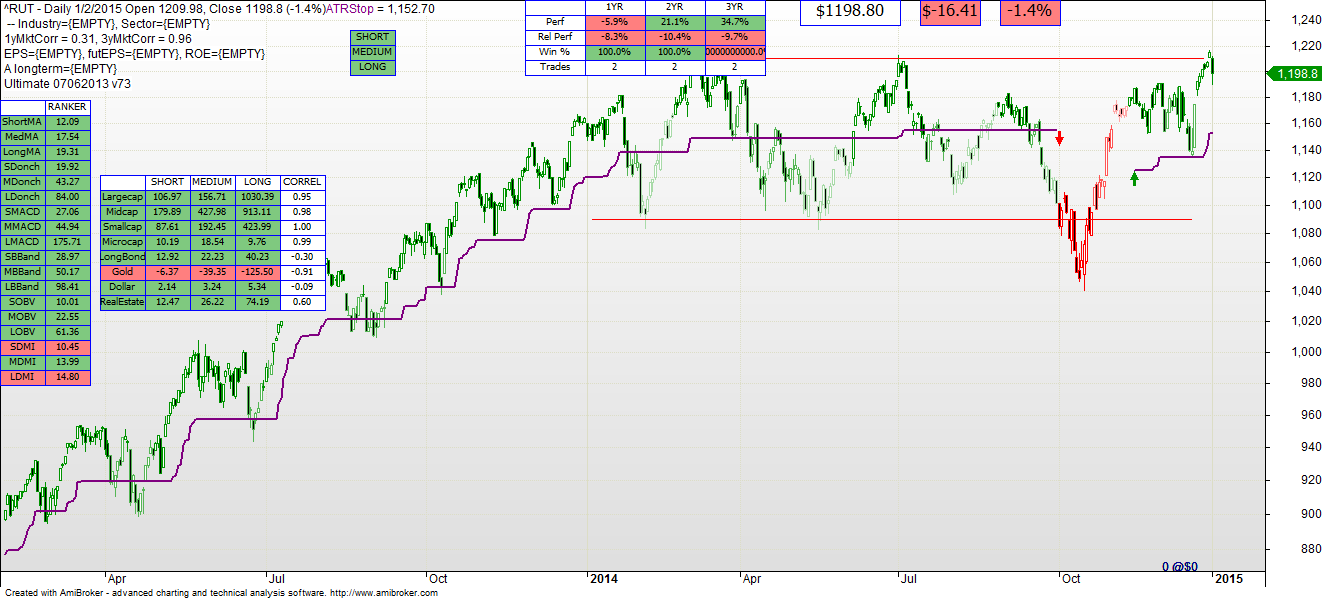

- The Russell 2000 small cap index lost 1.4% last week to 1198.80.

- Long Bonds (TLT) gained 2.3% last week to 127.32.

- Asset Allocation Model: unchanged at 49% Stocks, 32% Bonds, 19% Optional.

The technical models continue to consider the broad market as a BUY, as has been the case for some weeks now. The alert reader may notice that there is some deterioration along the edges, but not enough to change the overall recommendation.

The recommended Asset Allocation has changed only slightly in the past few weeks. It is “stuck” at nearly the highest recommended equity proportion, which in retrospect has been the correct pick.

As I’ve noted a number of times, small caps lead large caps. The Russell 2000 is at the top of a nearly year long channel as noted in the second chart below. It could shed 8% or so and stay in the channel. It would be more likely to shed 4% and move to the center of the channel. In any event don’t be surprised by a slight downward correction in small caps and perhaps a small downward correction in the broad market in the upcoming 45 day period. That will not signify a material shift in trend if it occurs over that period. It will not materially move the asset allocation model if it occurs over that period.