Prior Week Market Performance

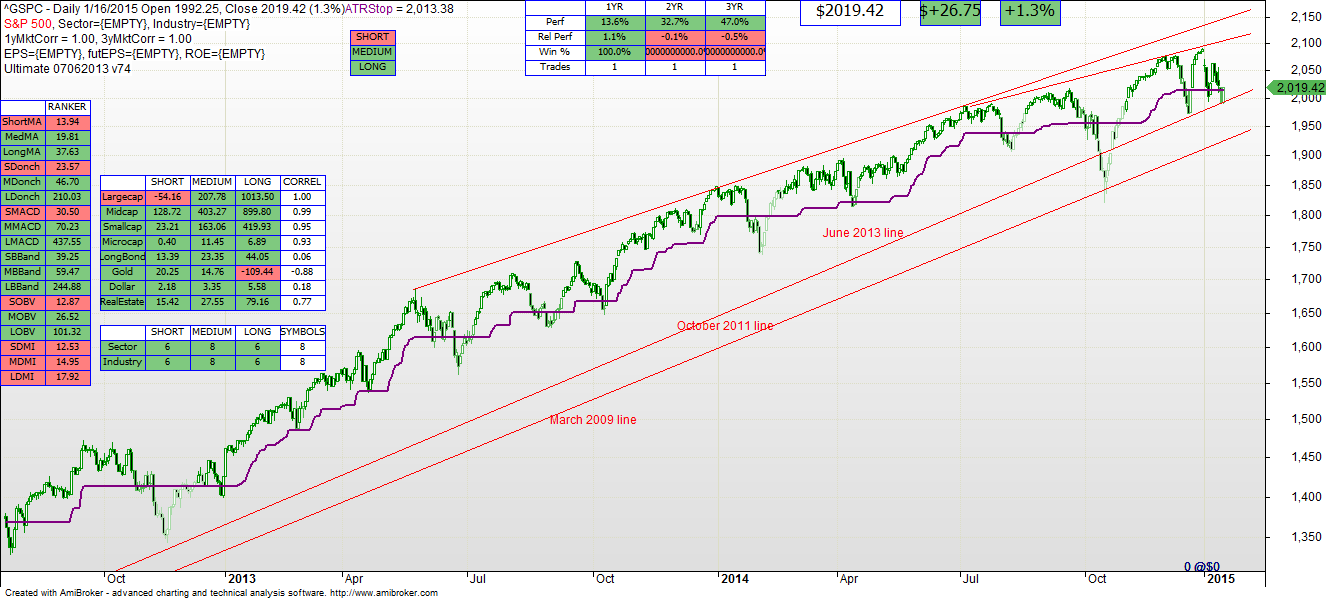

- The S&P large cap index lost 1.2% last week to 2019.42.

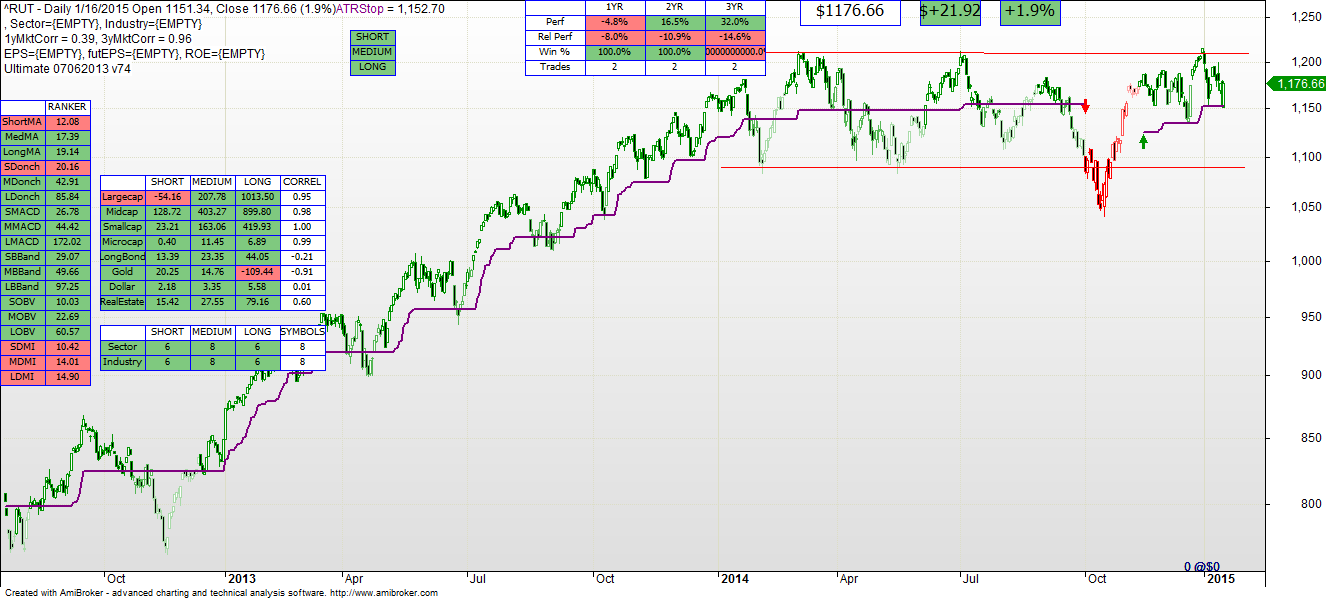

- The Russell 2000 small cap index lost 0.8% last week to 1176.66.

- Long Bonds (TLT) gained 1.6% last week to 133.19.

- Asset Allocation Model: materially changed at 44%(down from 52%) Stocks, 39%(down from 27%) Bonds, 17% Optional.

Last Week’s Commentary: room for slight downward trend but technical indicators all indicate BUY in medium and long term periods

This Week’s Commentary: actually for intermediate and long term investors the market is doing exactly what one might expect. You’ll note below that the S&P 500 is staying inside of an ascending trend (just barely), and the Russell 2000 has, as might be expected, reverted to the mean of the year long channel marked by the two red lines. The technical model has appropriately indicated that the S&P 500 is not a BUY in the short term. Long term bonds are moving up at too rapid a pace, but indicative of the underlying anxiety in other world currencies.

There is not widespread weakness in micro, small and medium cap markets, as indicated by the technical models that still show BUY.

The asset allocation model has predictably moved to bonds in light of the short term weakness in the large cap market. But personally I’d give this a week to see a confirming signal in the small and medium caps. Stay put until there is a bit more clarification in direction.