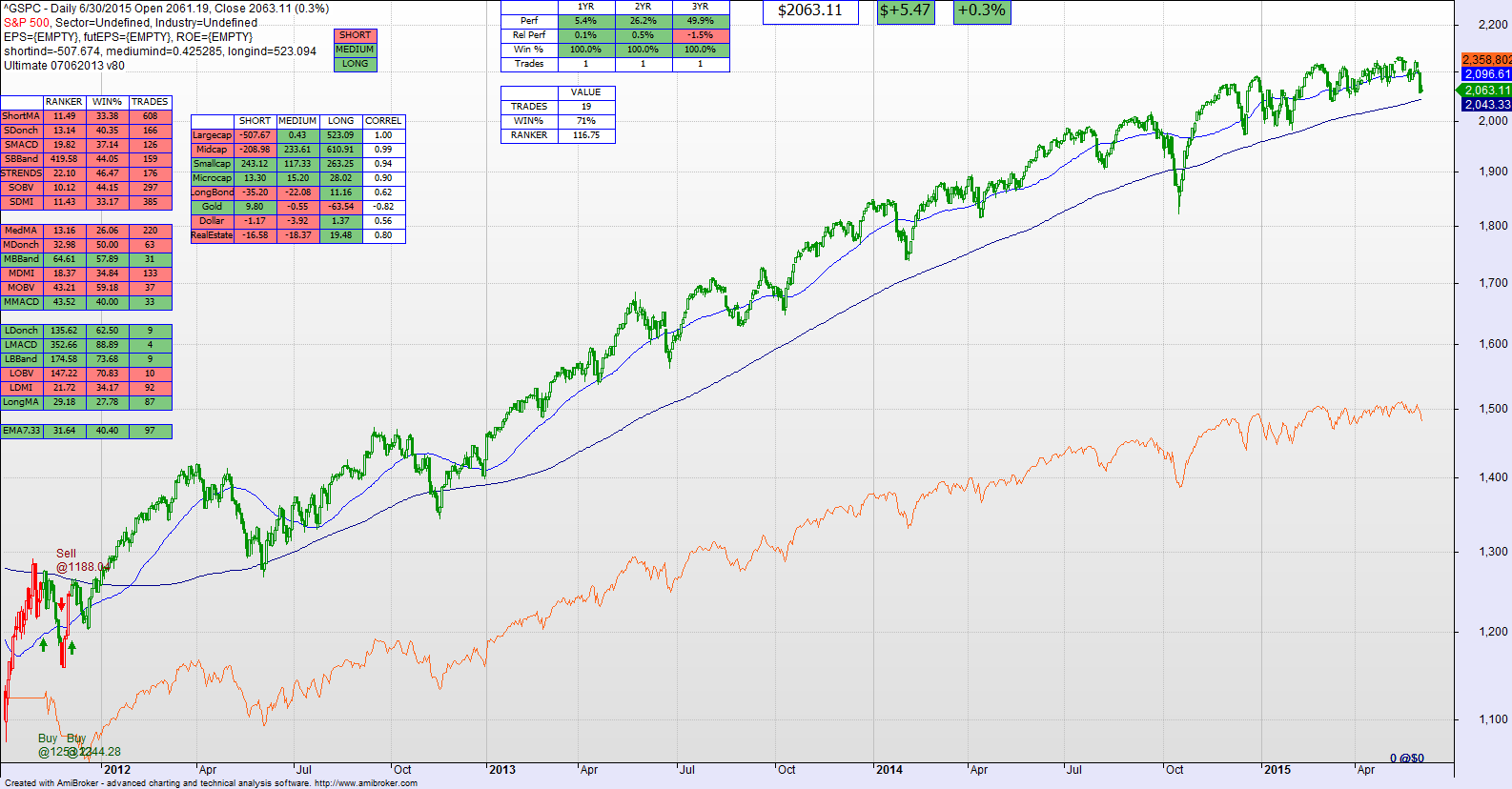

This is a snapshot of some pictures from the technical model after the past few days of Greek-related uncertainty.

The Short Term is a sell for the large and mid-cap markets, but things still look ok in the small and micro-cap elements of the market, likely due to the lack of overseas exposure. Long bonds continue to drag — the market continues to believe that rates will rise later in the year and that the Fed is serious.

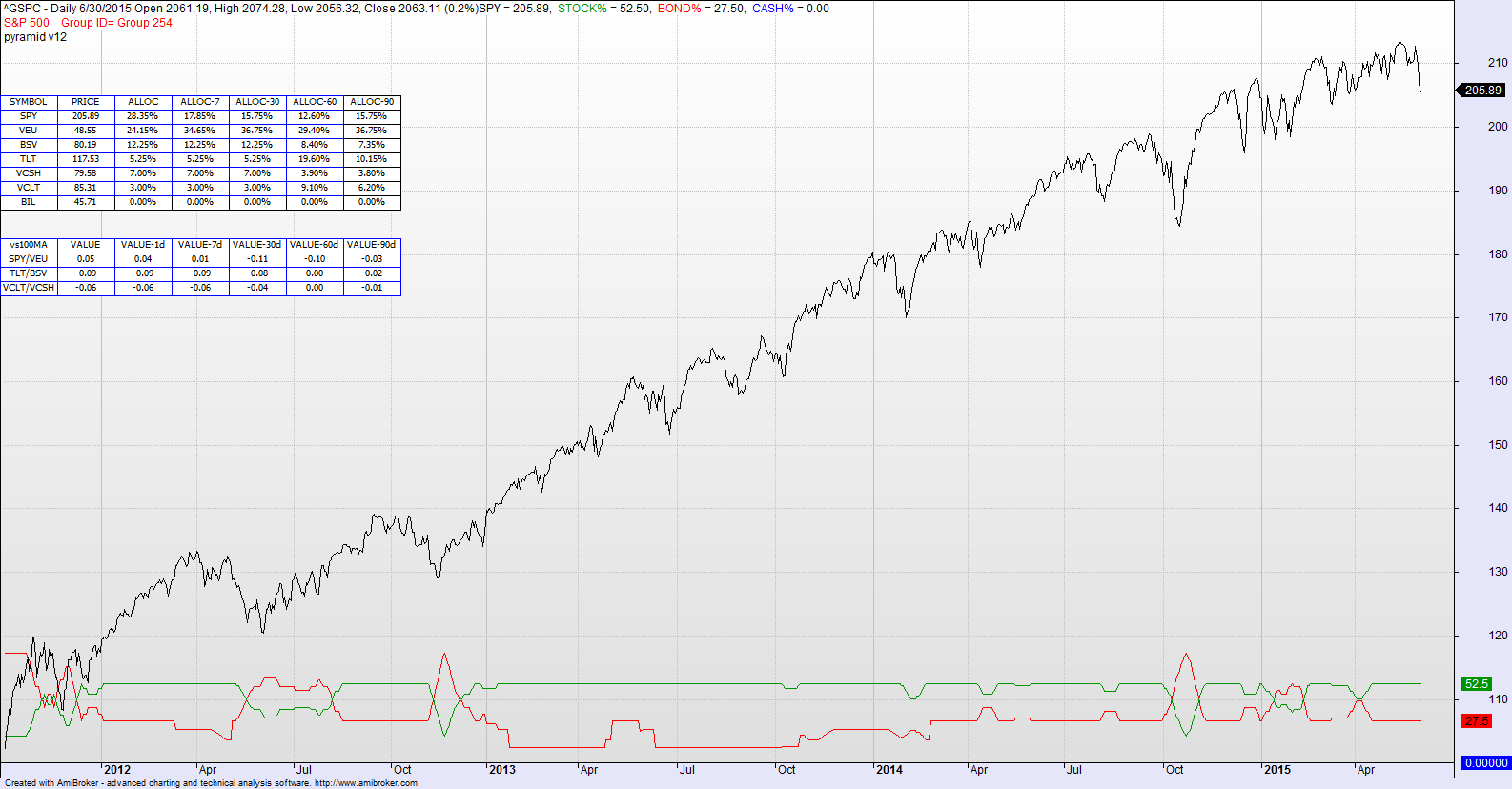

The target portfolio allocation has lightened its ex-US position but the bond proportion remains the same and in the same long/short allocations.

Technicians are seeing a “classic” head and shoulders pattern in the major market indices, the neckline being pierced with the drop yesterday. So there is some bear sabre rattling.

My sense just reading the charts is that we’d need another 2% drop in the S&P to pierce the 200d moving average, which itself has happened three times since April 2012. The small caps which usually lead the decline are not yet declining. The broad market model is still (barely) ok for Medium and certainly ok still for Long term. Hold your powder dry. Lets see which way this plays out.