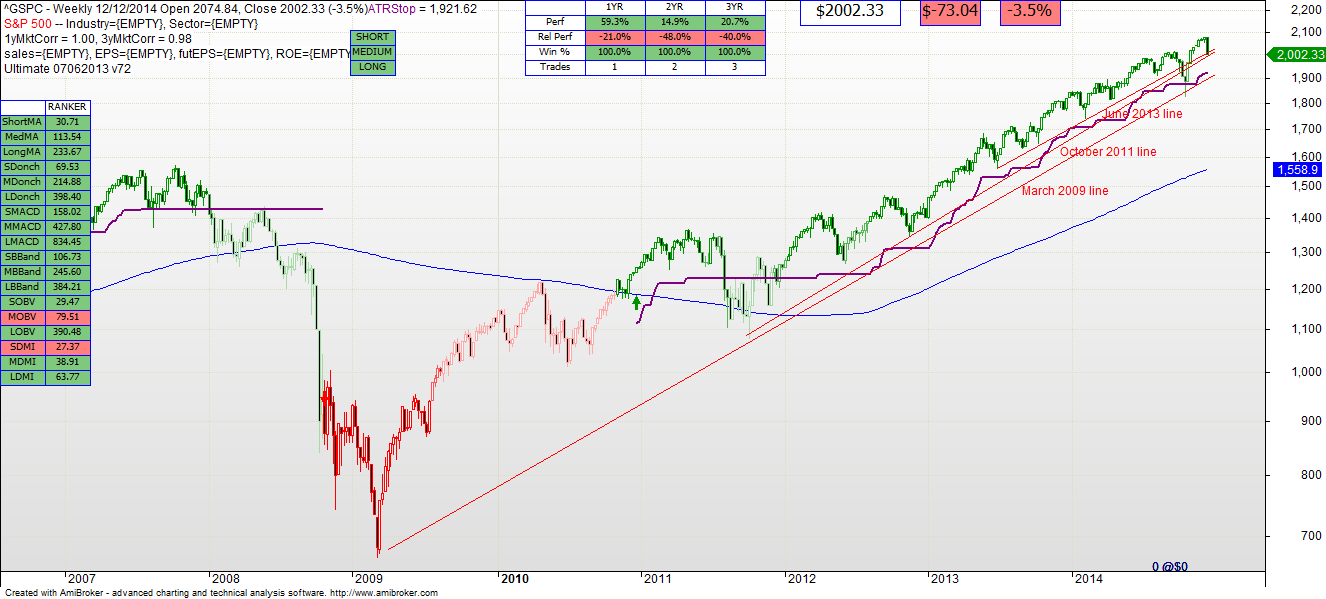

- The S&P large cap index lost 3.5% last week, rising to 2002.33.

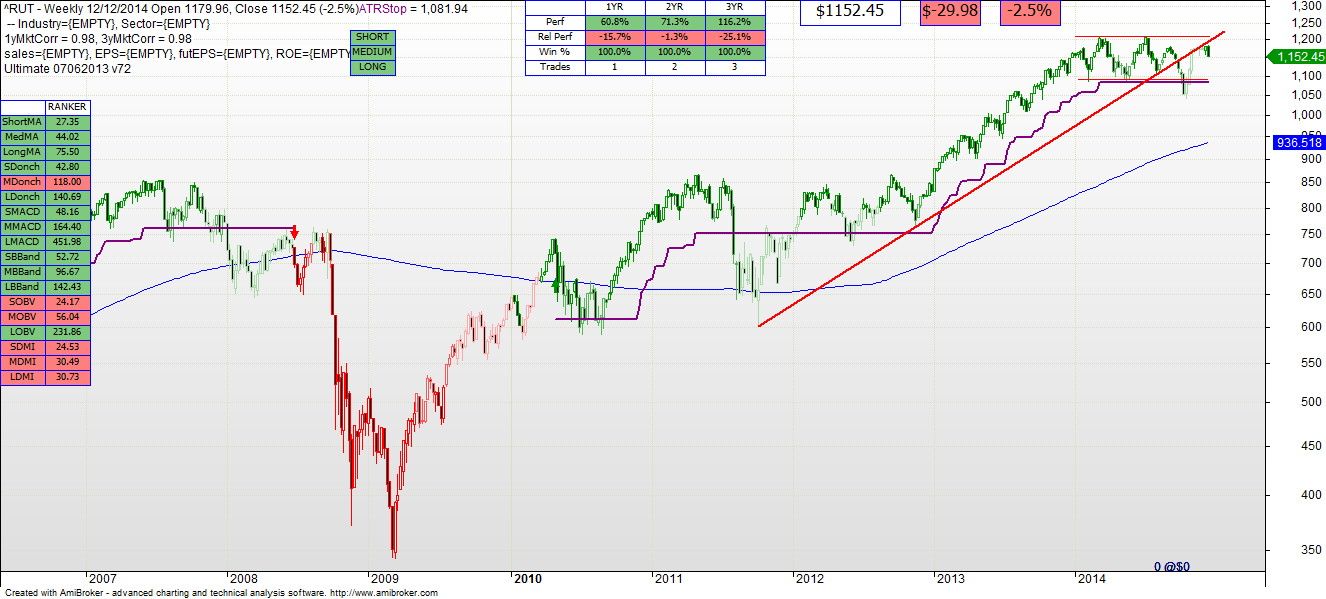

- The Russell 2000 small cap index lost 2.5% last week to 1152.45.

- Long Bonds (TLT) gained 4.3% last week to 126.30.

- Asset Allocation Model: unchanged. 52% Stocks, 27% Bonds, 20% Optional.

The S&P fell last week but did not violate the trailing chandelier stop. It pays to be diversified — Long Bonds rose 4.3% last week. For the long term investor, the Weekly S&P should give you some perspective. This past week’s adjustment was due, and does not in and of itself constitute a reverse in the trend. The technical models remain positive.

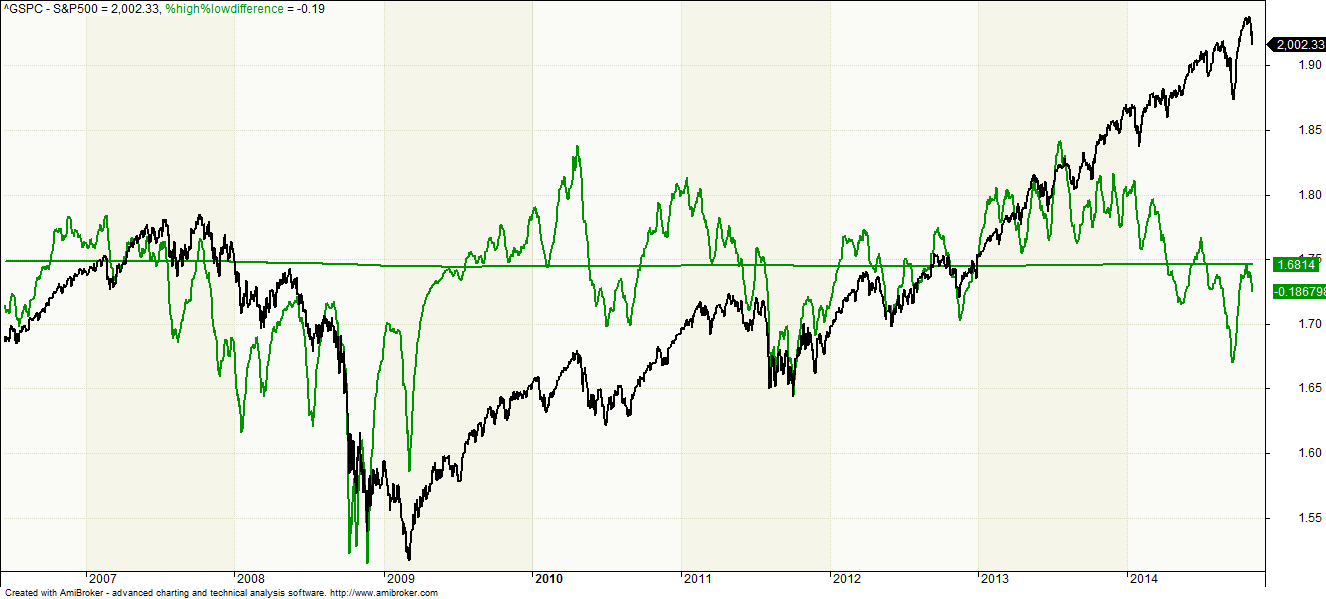

That being said, there are the usual, consistent signs of problems that should occur at some point. In particular, small-cap stocks (which serve as a leading indicator) continue to move sideways in a tight range, there is continued weakness in the number of stocks that are hitting new highs, and the ratio of advancers versus decliners continues to head south. But those leading indicators are not important until the overall market confirms the weakness. Which for large cap stocks has not happened. So as longer term investors we soldier on. Stay diversified.