Prior Week Market Performance:

- The S&P large caps lost 0.4% last week to 2108.29.

- The Russell 2000 small caps lost 3.1% last week to 1228.11.

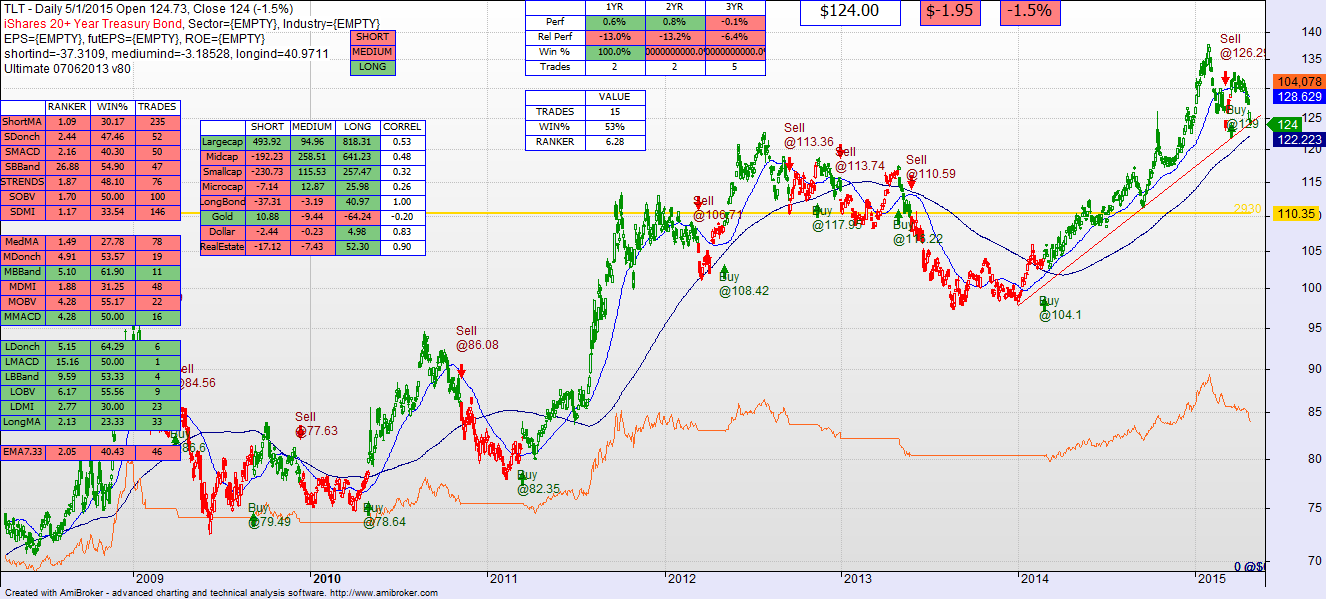

- Long Bonds (TLT) lost 3.9% last week to 124.00.

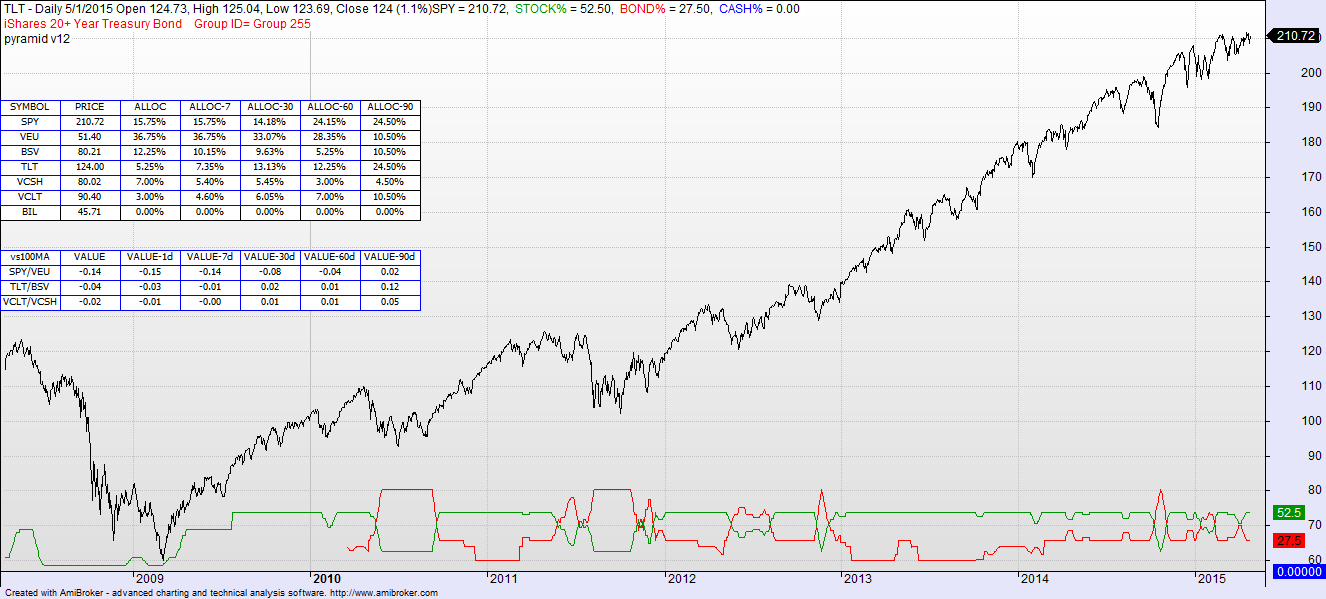

- Asset Allocation Model: Stocks – 52.5%; Bonds 27.5%; Discretionary 20%

Two Week’s Ago Commentary: Right now the market technical direction is unchanged. Still looks good in the intermediate and long term.

Current Technical Model Indicators (Short, Med, Long periods):

- Large Cap S&P 500 – BUY, BUY, BUY

- Mid Caps – SELL, BUY, BUY

- Small Caps – SELL, BUY, BUY

- Micro Caps – SELL, BUY, BUY

- Long Bonds – SELL, SELL, BUY

This Week’s Commentary: What you notice about this market right now are two things:

1) there is underlying weakness in small and medium cap equities that has not made its way into the large cap stocks. This is traditionally how market weakness starts and it is a negative omen.

2) bonds are particularly weak, so even though the overall equity market is weakening the asset allocation models are still indicating a full equity allocation as that is comparatively the better place for investment.

The S&P500 has not violated the 50 dMA and is well above the 200dMA. So at this point intermediate and long term investors should wait for more definitive signs, for example a further weakening of the smaller caps that bleeds into the larger securities.

Over the course of the last month the asset allocation model has shifted from Long Term (TLT) bonds to primarily short term (BSV) bonds in the percent holdings, with the current weight at 5.25% TLT/12.25% BSV. TLT is falling toward its 200d ma — if you have not rotated your bond position to primarily (2:1) shorter intervals you should do so in anticipation of what appears to be the possibility of a capturing the gain and a subsequent complete abandonment of TLT if it gets any worse.

There is smoke in the air and that might be a campfire and not a house fire, but we’ll keep an eye on things and if there are material movements in the models I will keep you appraised.