I was just reading today where the past six months has been one of the calmest times in the history of the market relative to daily volatility. So when the S&P drops 5.8% in a week it magnifies the loss, whereas in a normal run of things this kind of volatility would not be so uncommon.

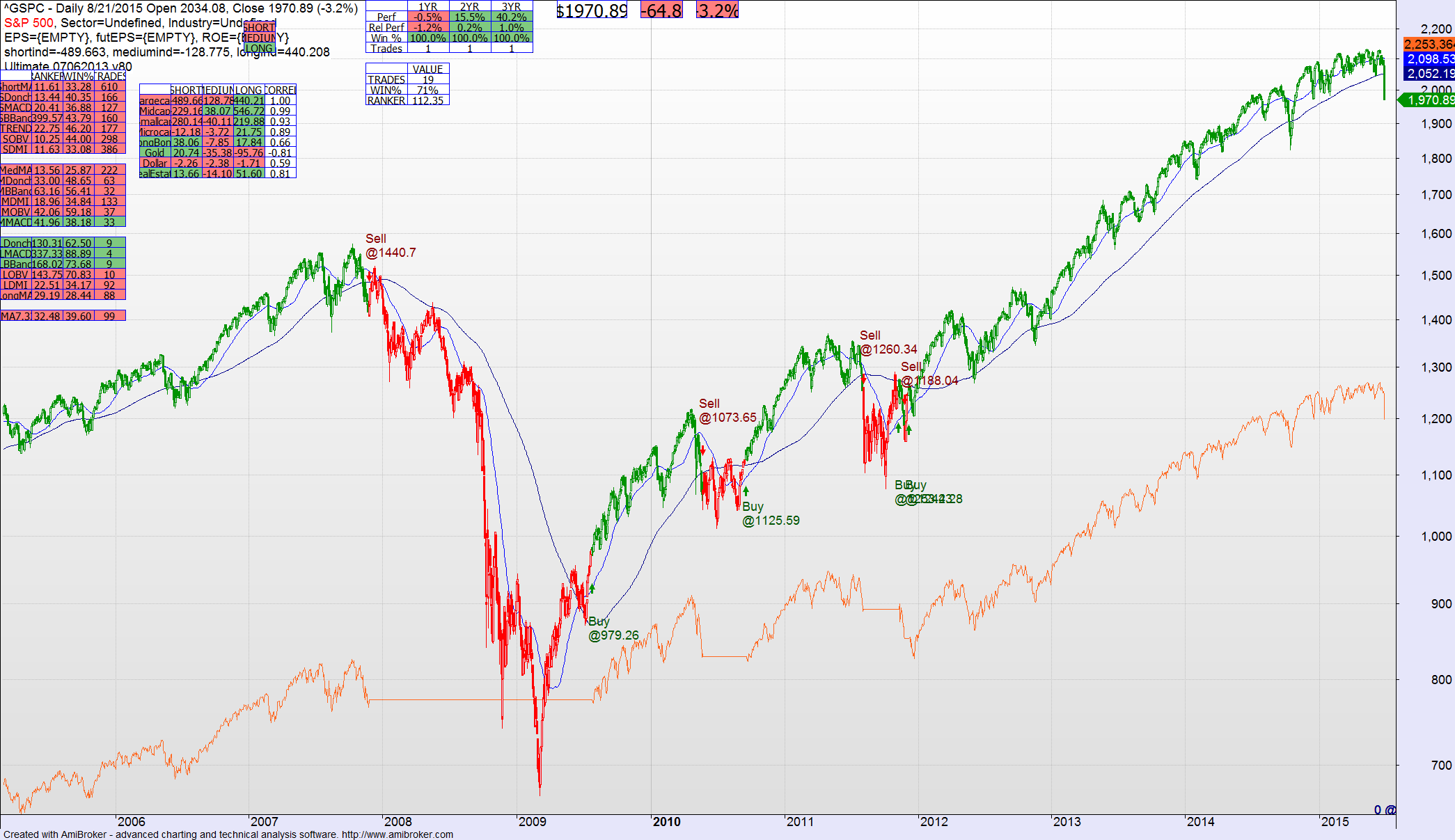

It will take quite a bit more downside to trigger a long-term SELL, and it is worth mentioning that if you look at things from a weekly basis it looks rather boring. Yes there is anxiety over North Korea, China, and a million other things, as there often is. But it will take more than this drop this week to look at the chart below and believe that one needs to fundamentally adjust a long-term trading position.

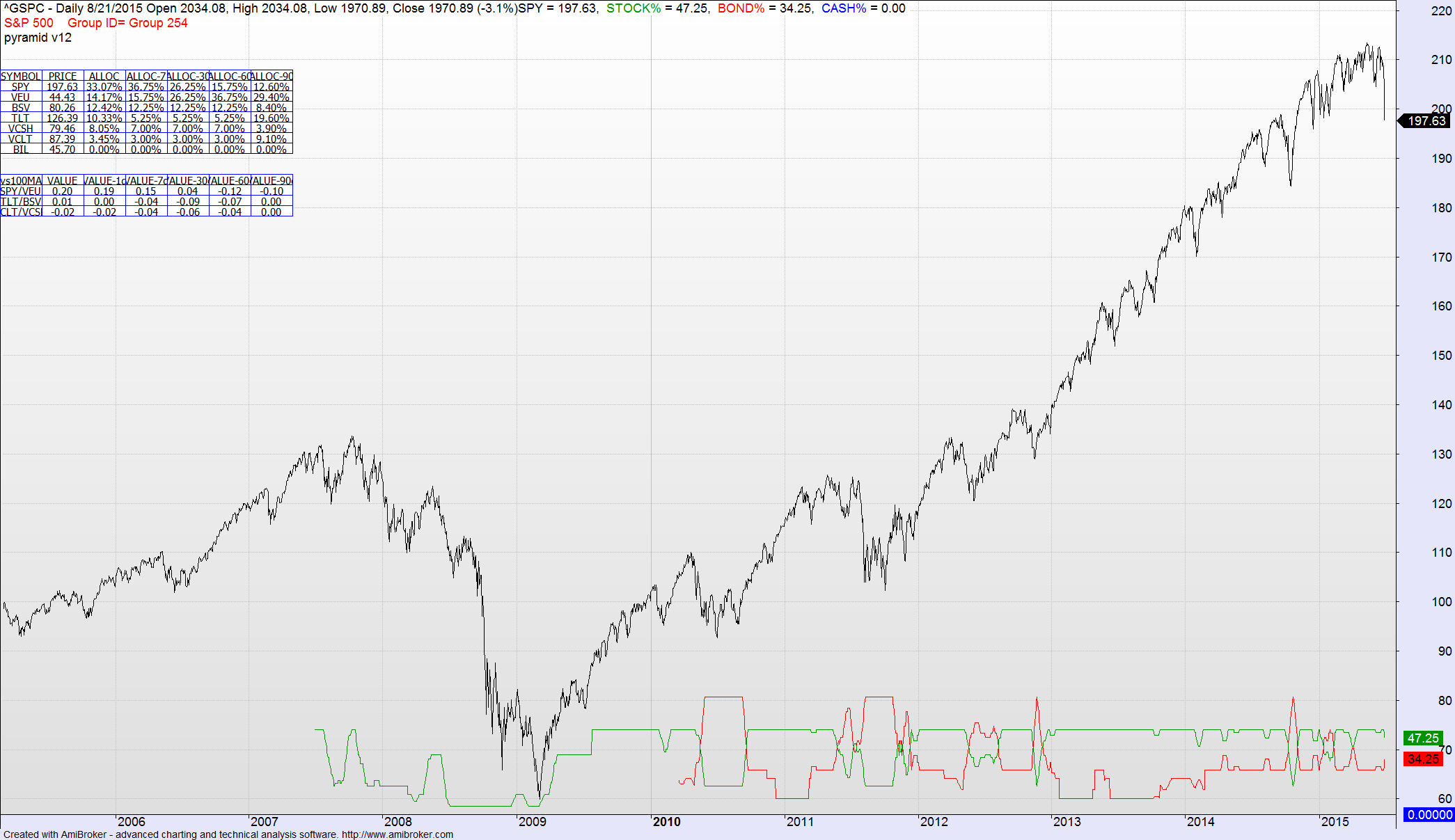

The asset allocation model has given back a few more equity basis points to a 47%/34% split between stocks and bonds. It started at 52%, and has moved 5% down. As I would normally wait until anything moved at least 500 basis points (5%) to act, if you are any bit at all nervous about this market you may wish to adjust your bond holdings to this split.

What happened this week is in my opinion the occasional 2 standard deviation variation from the mean and it will happen from time to time. Does not mean the end is near. Not yet anyway.