Last week I wrote:

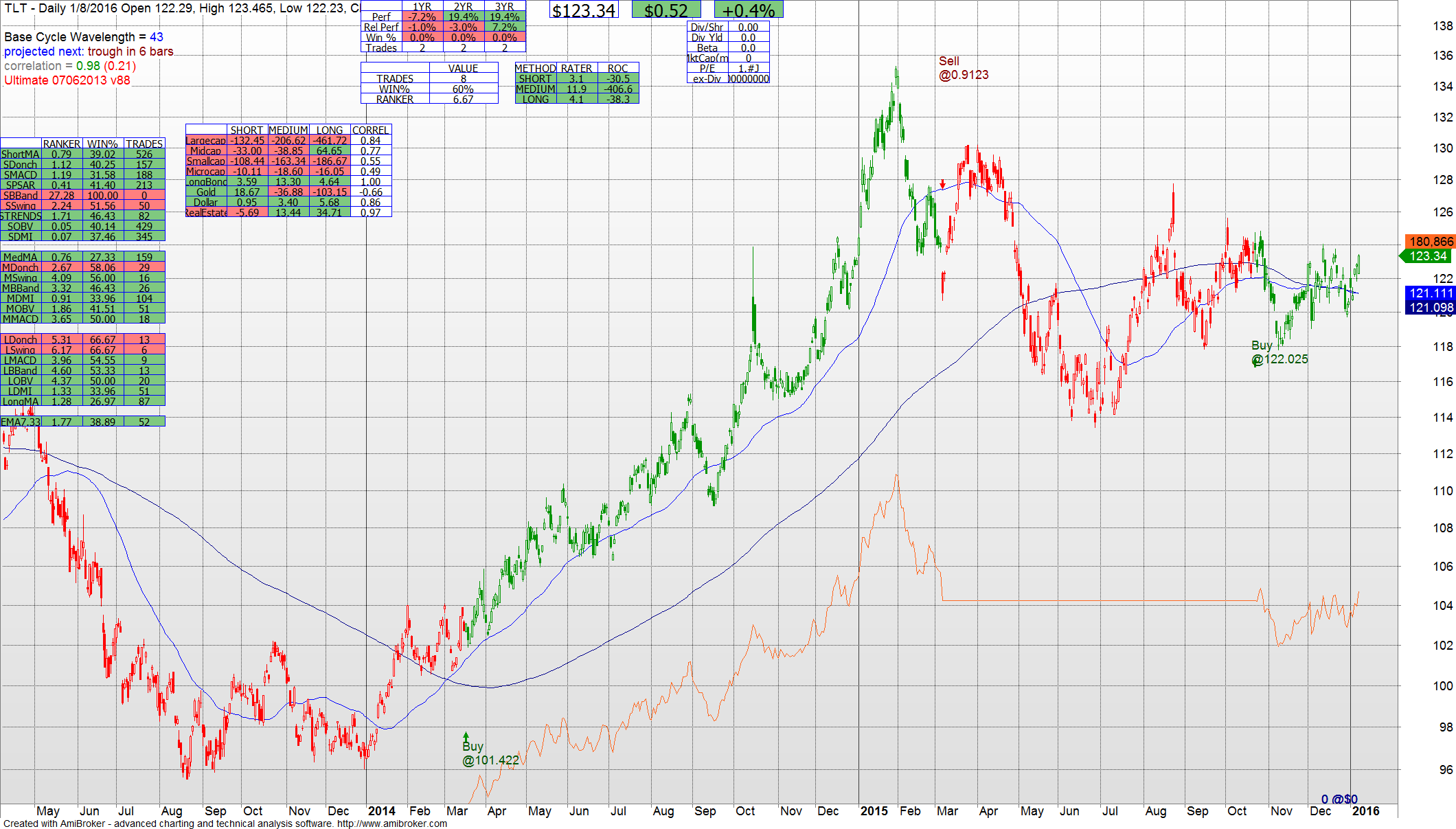

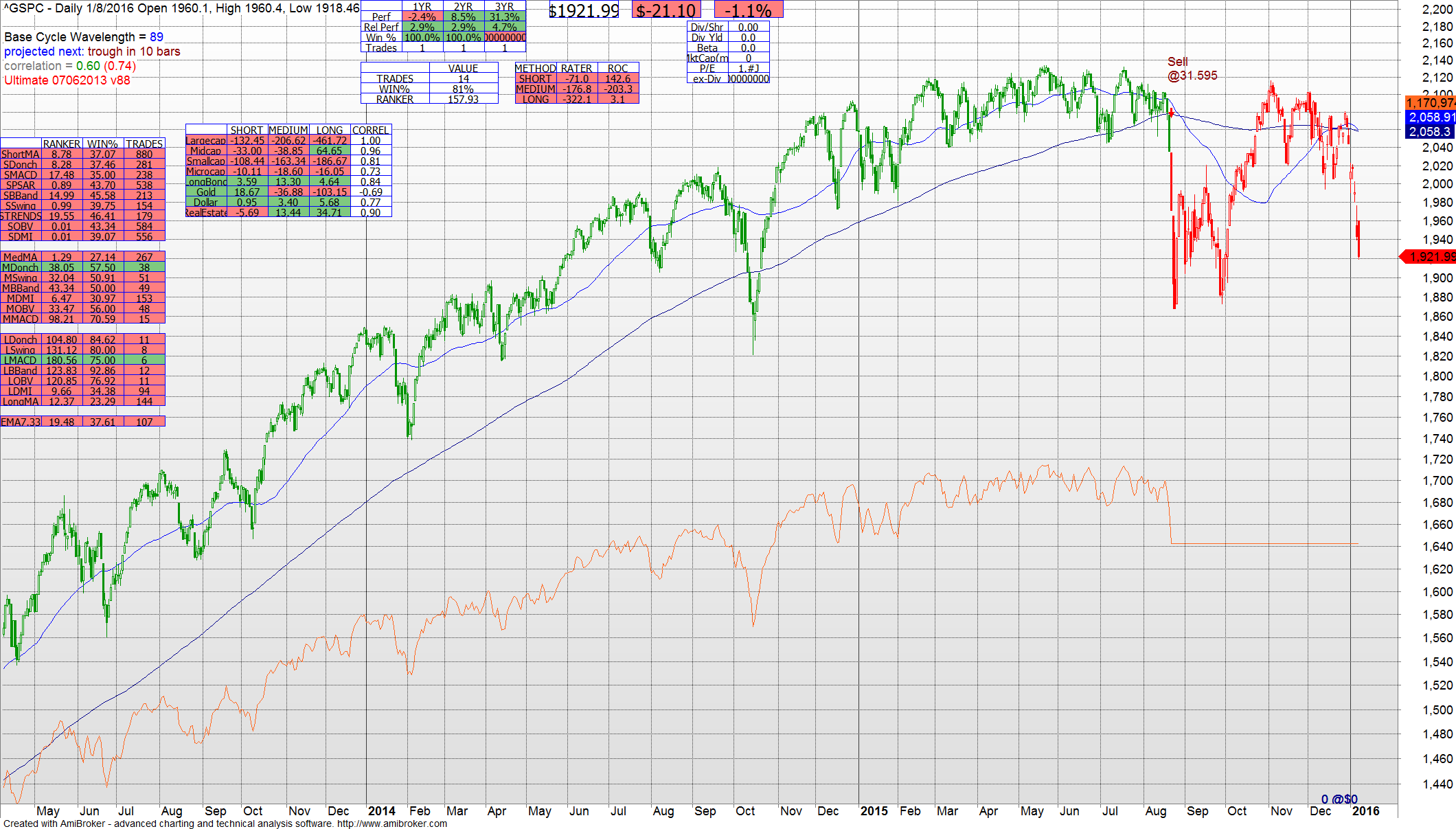

“The holidays have left us with a feast of mixed signals. But for an intermediate term investor there is considerable doubt about this market. Small companies are not confirming, the recent advances have been on low volume, and long term indicators are decidedly negative. A 75-25 asset mix of bonds/cash to the S&P still seems the appropriate mix of risk and reward. As volume picks up in January we’ll get a better indication of market direction.”

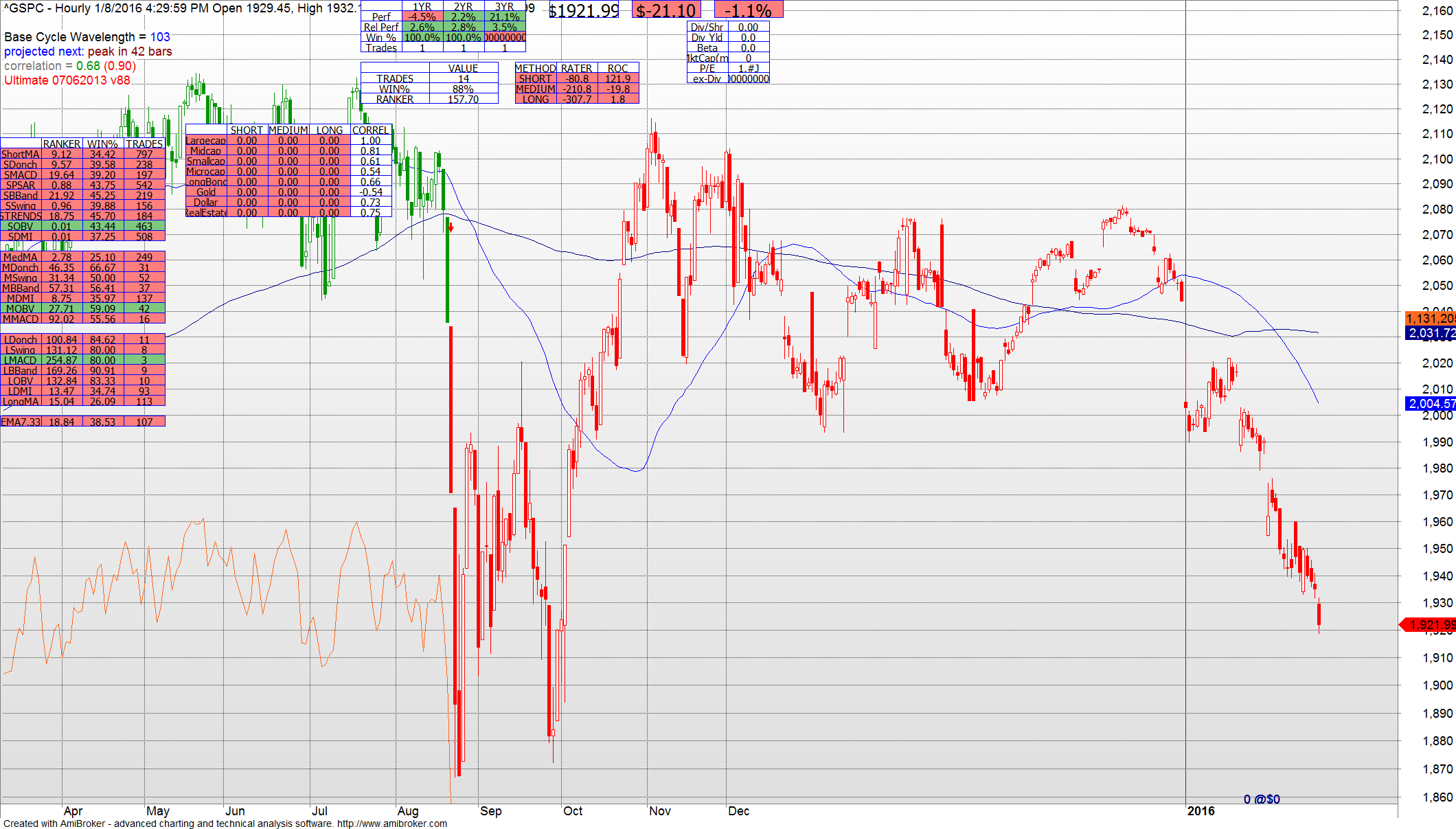

The models are decidedly negative for the S&P in all periods. At this point you should have no more than 25% of your wealth in market-correlated equities. If the S&P drops below the 1880 double bottom then we’ll likely recommend moving the balance of your market correlated position to bonds and cash. I’ll keep you posted intra-week if there is a material change in the advice.