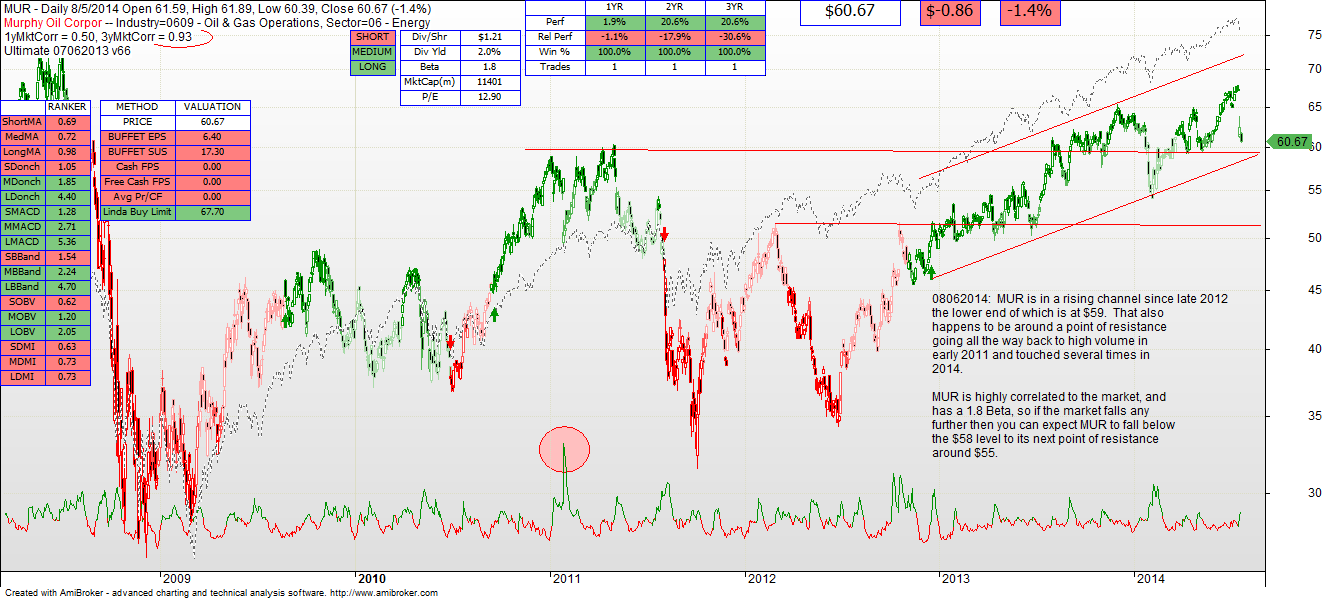

See previous post from Mike Bates. I opened up a new post so that I could post the graphic below — otherwise this would have been a comment on Mike’s observation.

MUR technically looks like it has some resistance at $59, and again at $55. Given its high three year correlation to the market, and large beta of 1.8, a drop below 58 is not unlikely. A drop below $57 would result in a Club loss. I suspect that at least temporarily we might see a drop below $57, but it is the $55 level that would be the indicator. If this stock drops below $55 it also likely means that the S&P has dropped below its long term support trendline. Technical indicators right now mirror that of the S&P — short term SELL but holds for Intermediate and Long term. The $55 line is the material one here.