The S&P gained 2.5% in August closing out another month where there was a mid-month drop followed by a recovery prior to month end. All three model portfolios on this site are doing well (results since January 31):

- Miley Growth: +31.5%

- Miley Income: +21.4% not including dividend income

- ETF Retirement: +14.2%

To keep these amounts in perspective, two benchmarks (results since January 31):

- S&P 500: +22%

- AGG (Intermediate Bond Fund): -1.1%

I attended two different technical investing organization meetings as a member last week: the ATAS (Atlanta) and TSAASF (San Francisco). To give you a sense of what is being discussed I am including two slides of interest.

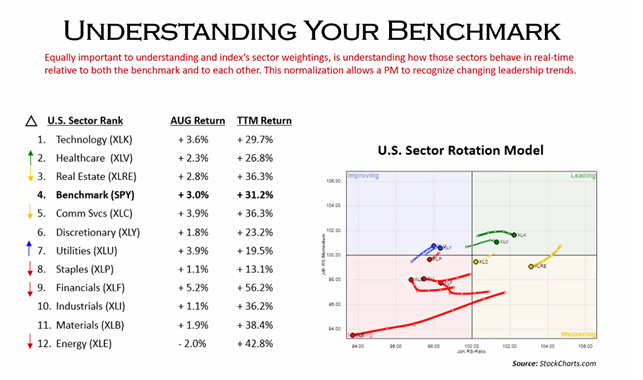

The first is a rotational graph presented by Jeffrey Huge of Alpha Insights during a TSAASF presentation. This is a picture of how each of the industry sectors is performing relative to the S&P. The x axis is the relative strength, and the y axis is relative strength momentum. Each versus the S&P. Technology, Communications and Discretionary make up 50% of the S&P index. Those that manage money professionally won’t beat the “market” by equal-weighting the S&P. So professionals look for opportunities where some of the core weighted items like Communications are slipping, and they shift monies into areas that appear stronger, such as Healthcare or Utilities. Or as it has been for sometime, they overweight technology and the money flow causes outperformance of this segment versus others.

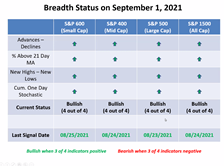

The second image is that of breadth. The ATAS meeting starts each month with a discussion of breadth. Joe Kupchik’s analysis appears historically to signal, more often than not, a market retracement if breadth weakens. At this point breadth has firmed up relative to July, and across various market caps and indicators the breadth still appears strong. This seems to indicate continued upward movement in the S&P. In my mind this is evidence of a “Fed Put”, where people feel that the market is bulletproof and they just want to get in while the getting is good.

It is a running joke, in the meetings, that sooner or later this bull market gravy train is going to end. Make sure you stay diversified and rebalance your holdings, locking in some profit so that you are not overly invested in technology, communications and discretionary segments that overweight the market as it stands today.