Prior Week Market Performance:

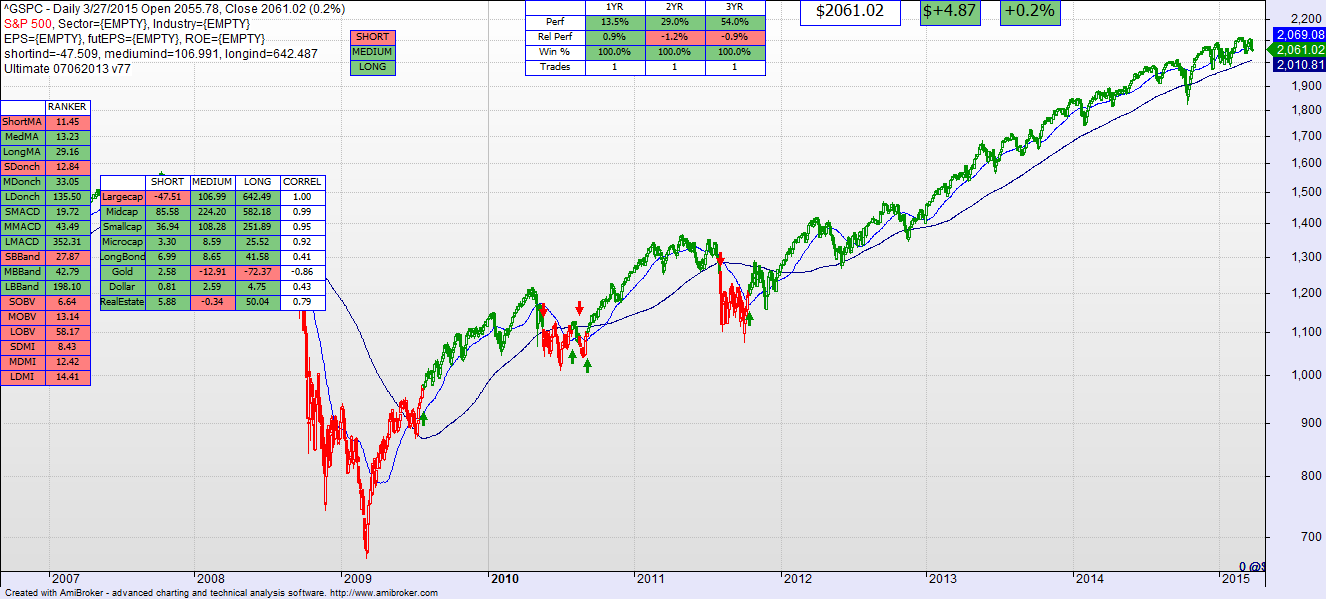

- The S&P large caps lost 2.2% last week to 2061.02.

- The Russell 2000 small caps lost 2.0% last week to 1240.41.

- Long Bonds (TLT) lost 0.3% last week to 131.06.

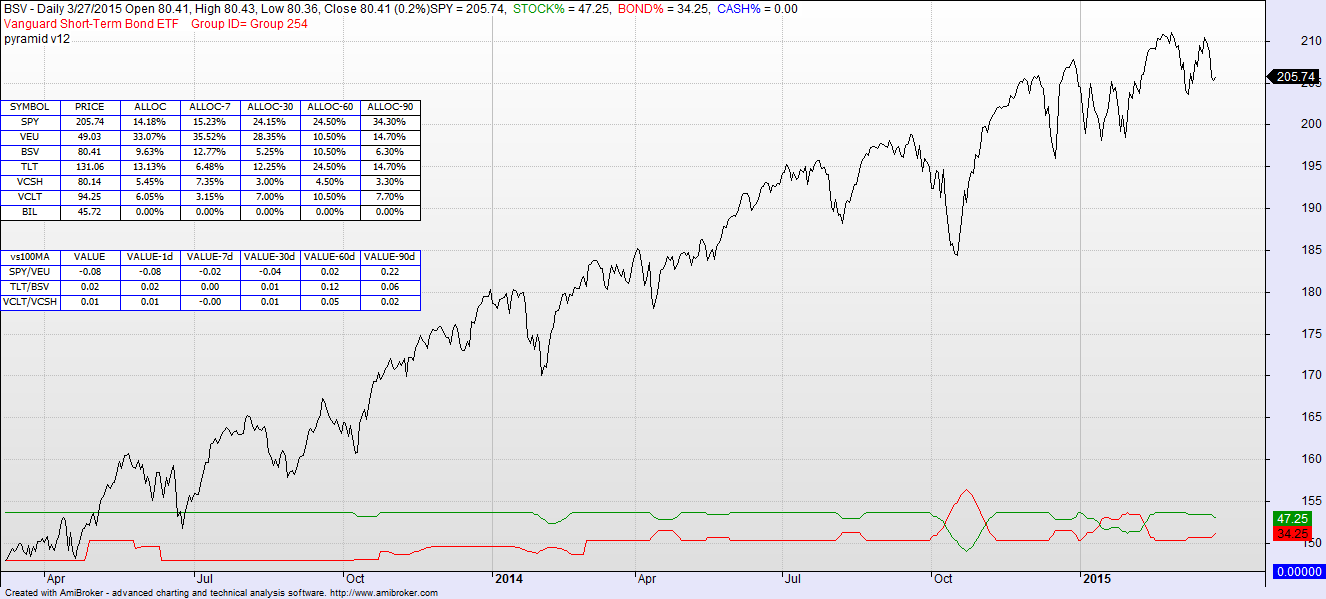

- Asset Allocation Model: Stocks (dropped to 47.25% from 52.5%); Bonds (rose to 34.25% from 27.5%); Discretionary (18.5%)

Last Week’s Commentary: This cannot go on forever, but for right now everyone is an investing expert. As long as the Fed sets the table the market will eat. For now.

Current Technical Model Indicators (Short, Med, Long periods):

- Large Cap S&P 500 – SELL, BUY, BUY

- Mid Caps – BUY, BUY, BUY

- Small Caps – BUY, BUY, BUY

- Micro Caps – BUY, BUY, BUY

- Long Bonds – BUY, BUY, BUY

This Week’s Commentary: The market dropped a bit last week and large caps shifted to SELL, but there are reasons to only light the inquiry sign and not overreact:

- Midcap, smallcap, and microcaps are all solid technically

- the S&P is above the 50day MA

- Long bonds still look OK — technically.

- The VIX is still historically low (relative to recent history)

Consider the VIX. It is a measure of investor anxiety. The chart below is a monthly VIX that shows the VIX is still below the trailing VIX 50day moving average and its 200d moving average. Until the VIX lights up the smart money is still betting on the current trend.

Lots of chat in the media about Fed timing on raising interest rates, and as a result the market seems a bit more volatile. People are trying not to be the last out the door when the Fed starts raising rates. Whenever that might be — there have been false alarms over the past number of months.

Please note the slight shift to bonds in the Asset Allocation model. Again only an indication of fraying, and a reason to light the “Inquiry” sign (as they say in Kentucky), but not a reason to panic.